The banking industry is facing a wide range of challenges.

Most obvious is the global economic slowdown, which has exposed the sector to the challenge of getting back to growth.

Alongside this, the cost of doing business has become more expensive with the recent increase in the Goods and Services Tax (GST).

Banks and lenders are trying to cope with the increase in operational costs and changes in regulations introduced by the government.

At the same time, technology continues to advance, and financial services firms have realized the importance of keeping pace with these changes.

As a result, we are seeing many firms develop and introduce innovative products and services, and banks are competing with each other to offer more financial services to consumers.

Going digital and meeting future needs

Fintech firms are emerging as successful competitors for banks as they have developed financial services faster and cheaper, tapping into the immense potential of technology.

This has resulted in a shift in the way consumers look at financial services and banks need to understand the changing needs and expectations of their customers to stay ahead of their competition.

As the banking industry evolves, consumers are looking for more financial services that are delivered through a digital interface.

This shift has put pressure on banks to offer digital solutions to enable a seamless digital experience for their customers.

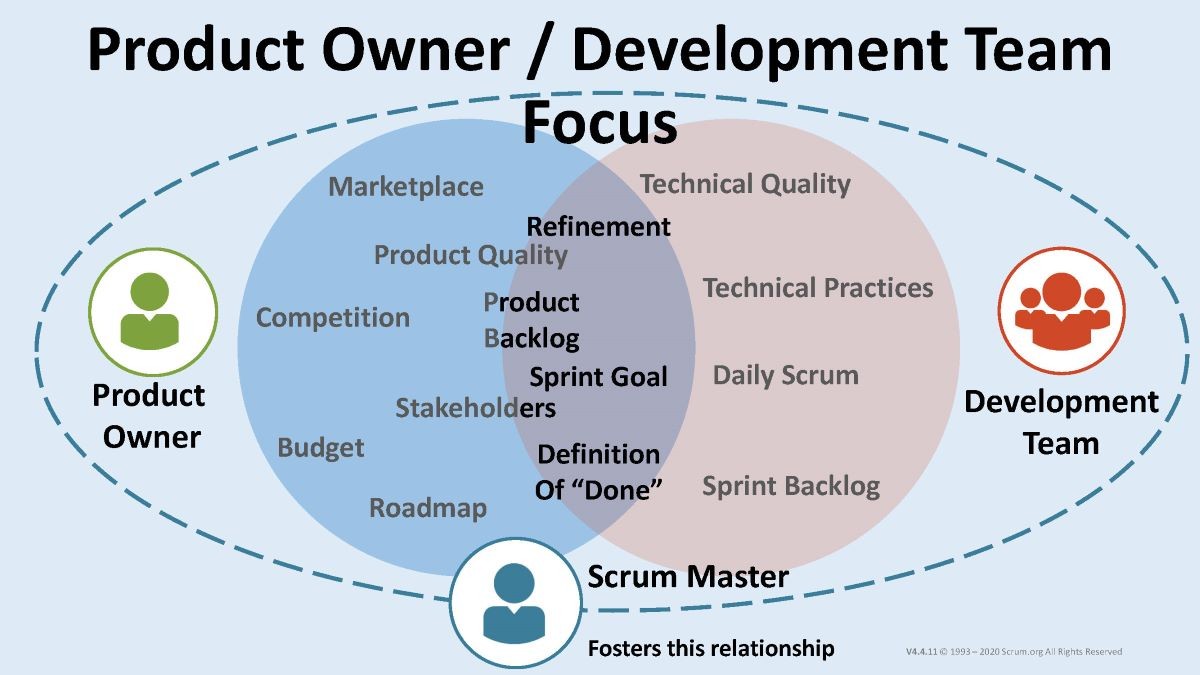

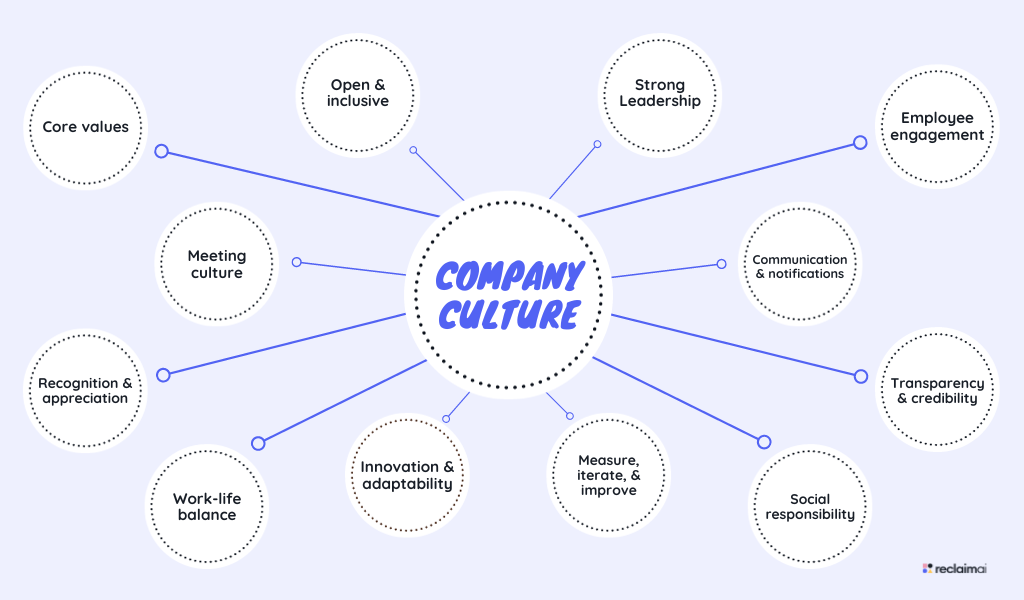

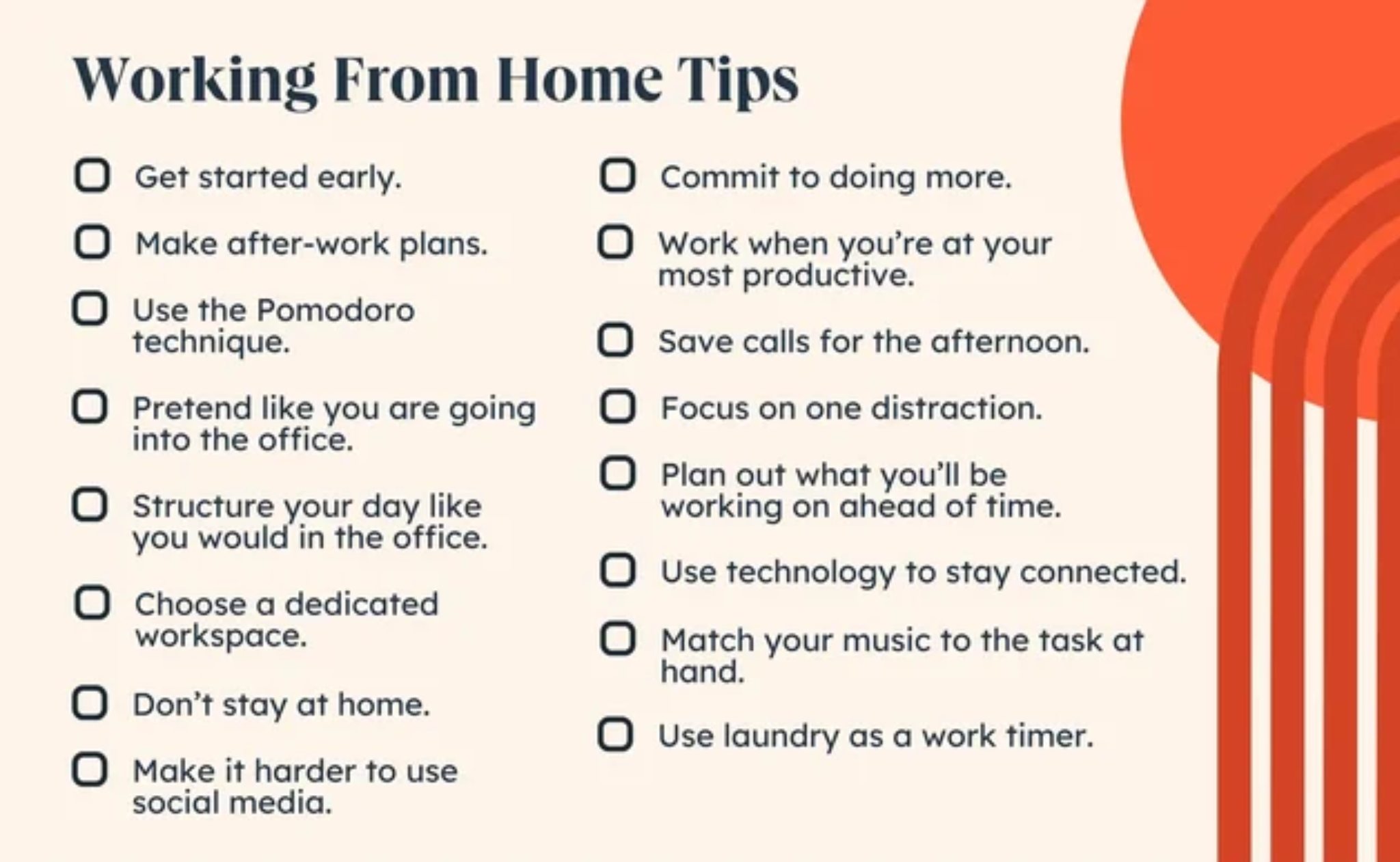

Agile approach

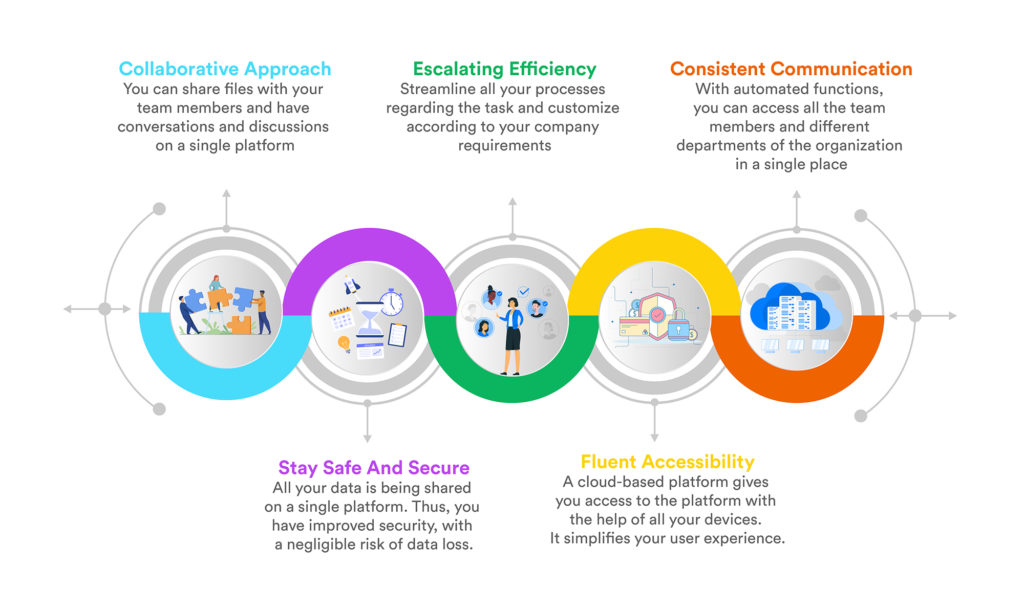

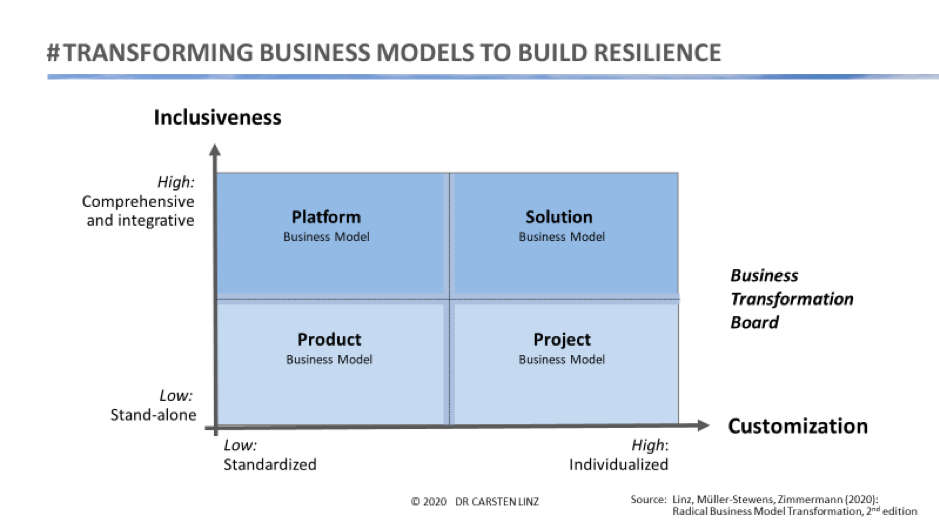

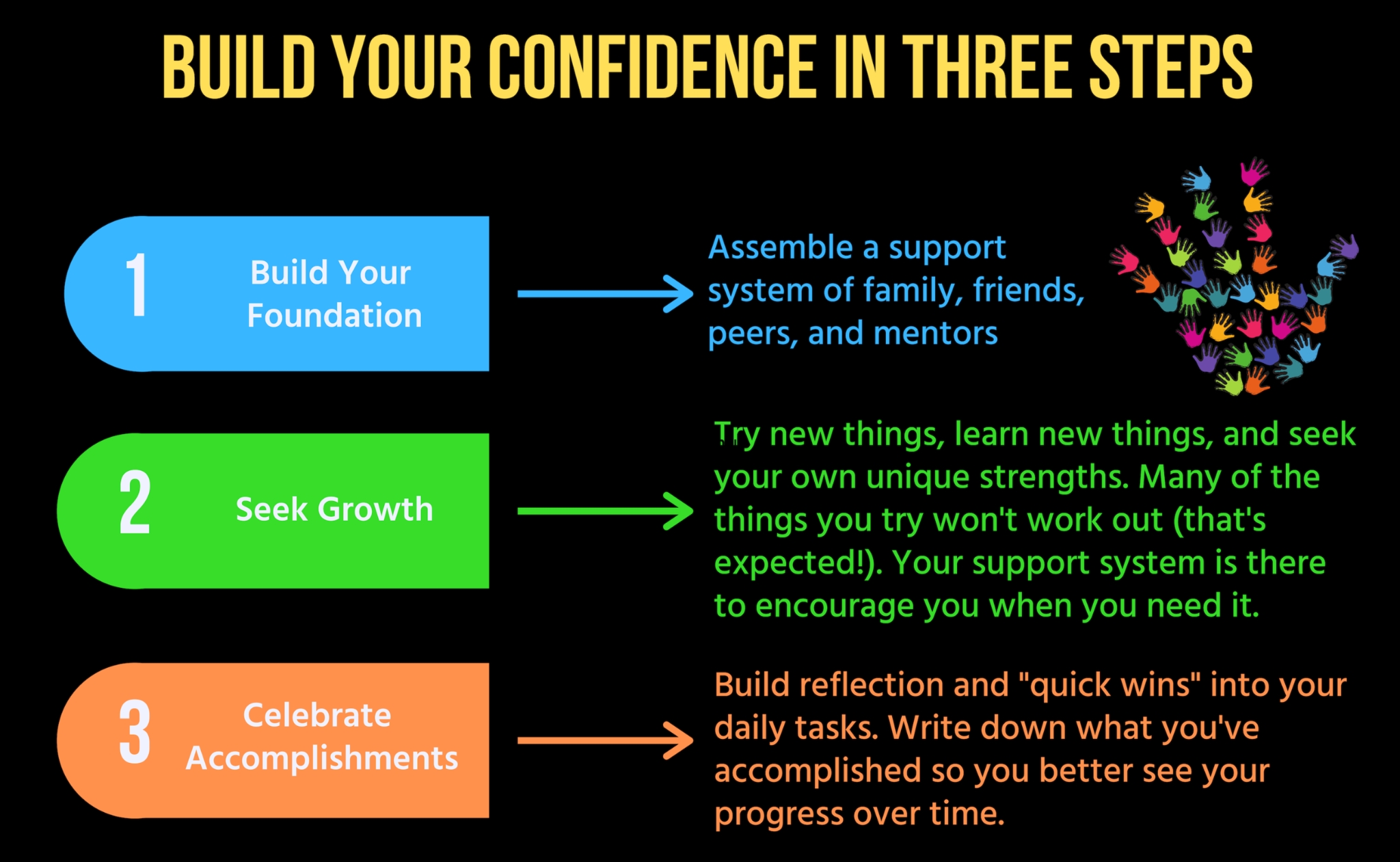

For banks to be able to engage with customers in a manner that is convenient, they will need to adopt an agile approach to business development.

Banks can start with defining key values that will enable them to develop business solutions to meet the needs of the customers.

An agile approach can help banks innovate quickly and reach out to the right customers most efficiently and cost-effectively.

In the digital age, banks need to be able to offer a complete digital experience, from information and products to delivery.

By adopting an agile approach, banks can give customers the satisfaction of completing their banking transactions quickly and easily and providing the exact service that they are looking for.

Customer-centric approach

Another way to remain ahead of their competitors is to give customers a truly satisfying customer experience.

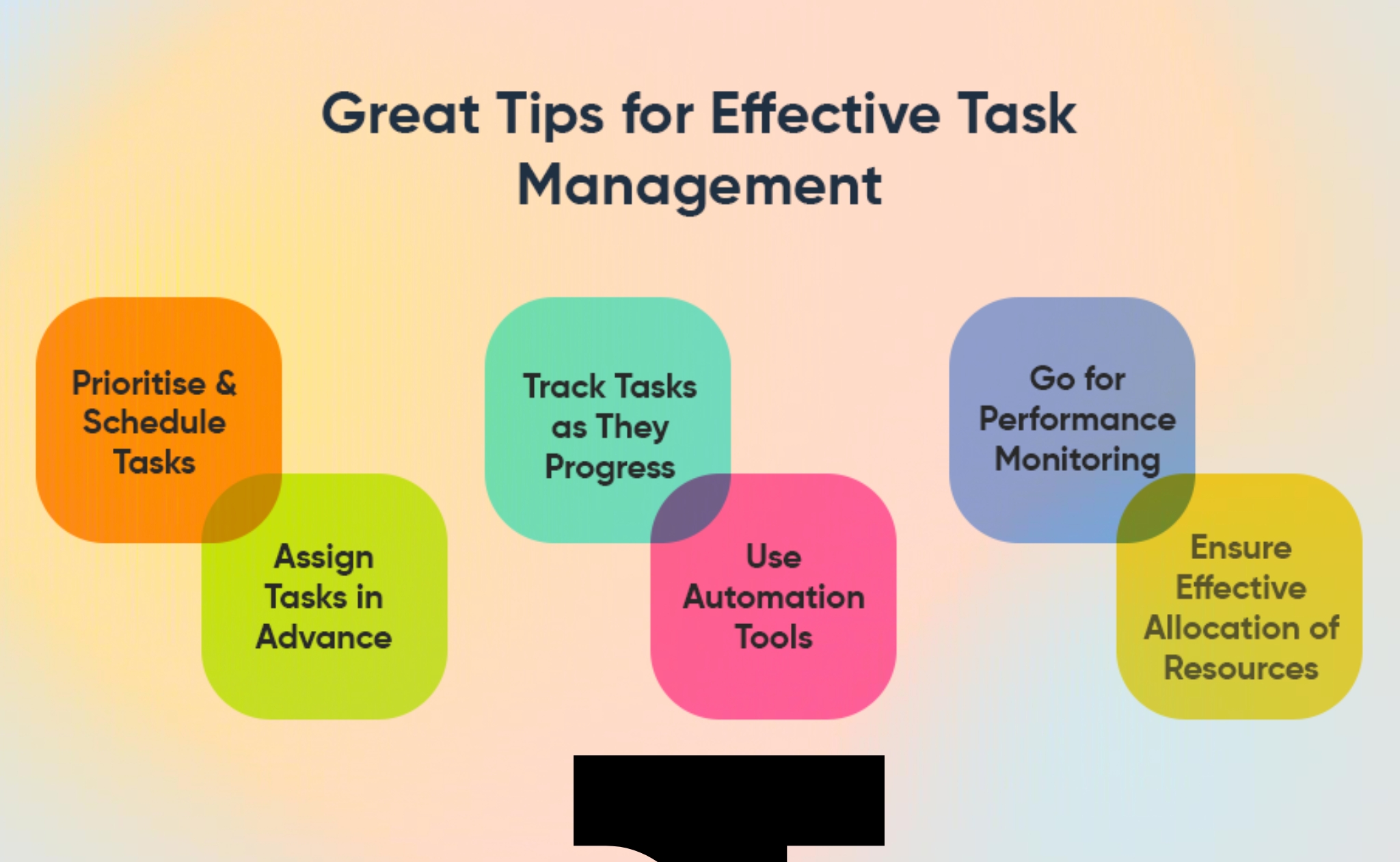

Businesses need to constantly monitor how customers interact with their product or service, including how they use the product and when they use it.

By doing this, companies can make improvements to their products and services to ensure that they meet the expectations of their customers.

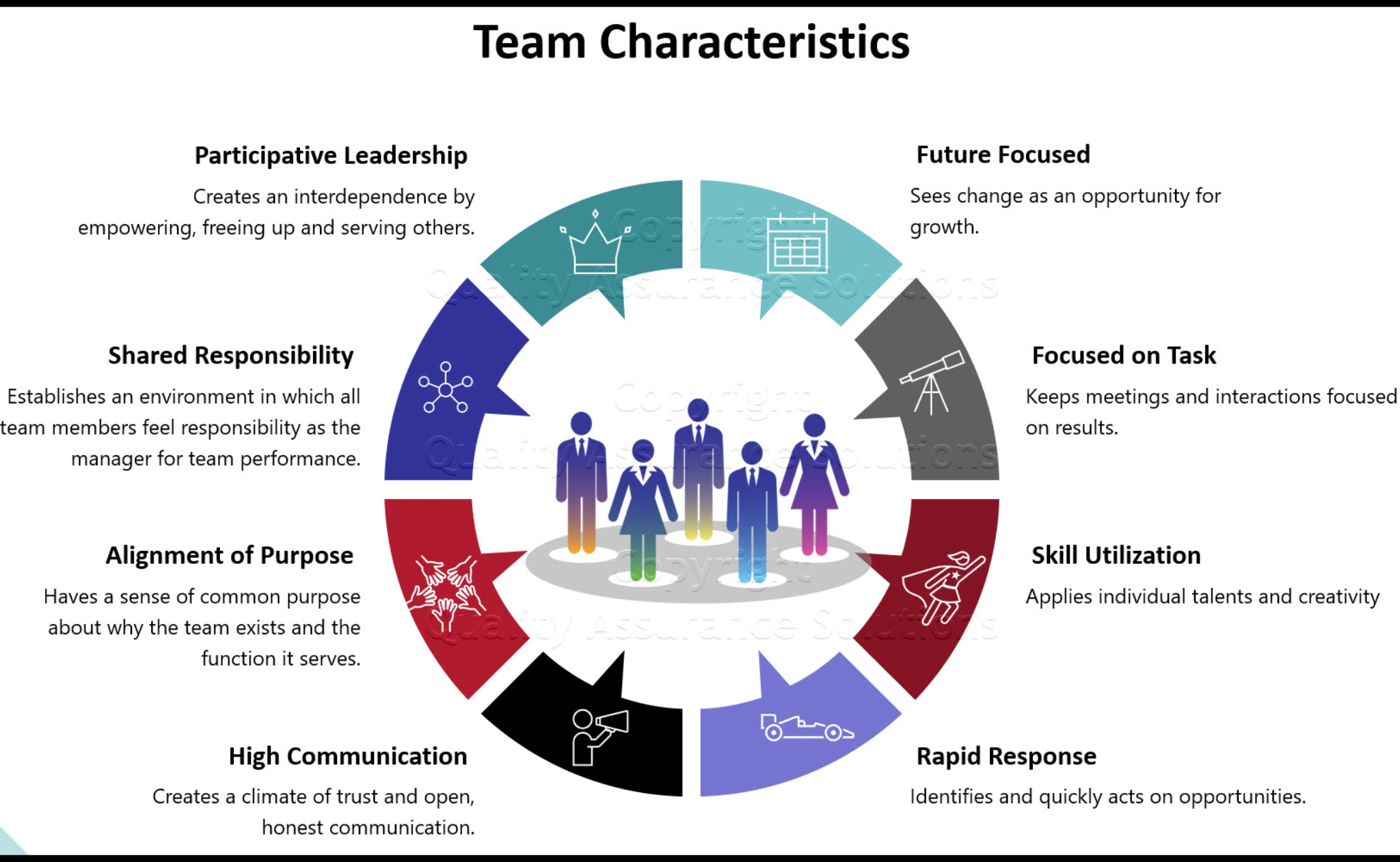

Creating a network of stakeholders

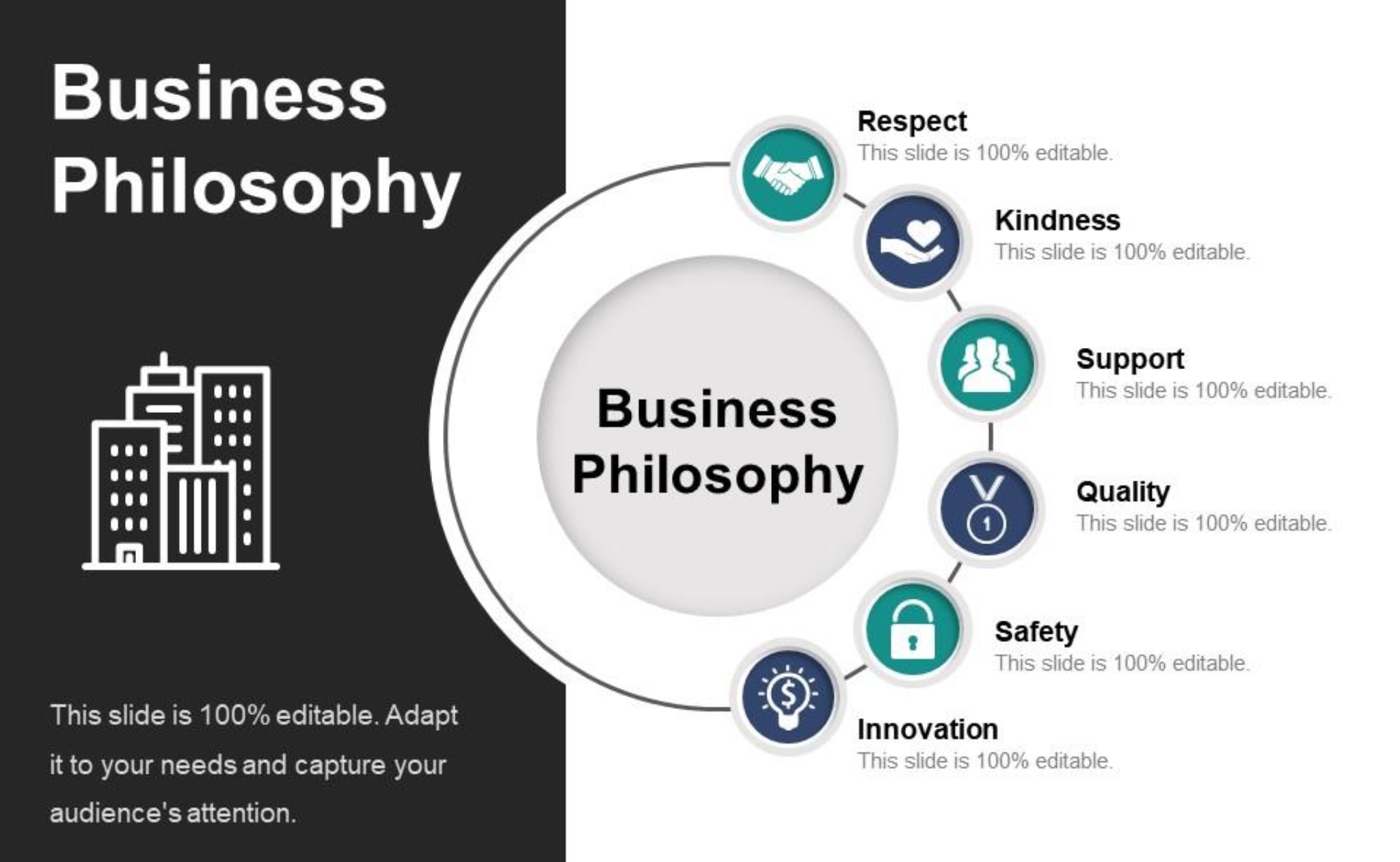

These different perspectives will help banks get ready for the future and stay ahead of their competitors.

They will need to find a way to create an “ecosystem” of consumers, stakeholders, partners, and technology to deliver an integrated experience.

Banks need to ensure that they collaborate and work together with stakeholders, customers, and partners to gain a 360-degree view of their customers.

For example, a bank will need to have a vendor system that enables it to implement and manage multiple technology platforms to deliver the complete digital banking experience.

Ultimately, banks will need to evolve to meet the changing needs of their customers in the digital era and help them achieve their financial goals.

To effectively transform their businesses, banks need to embrace technology, become agile and seek strategic partnerships to gain a competitive advantage.

Rebranding

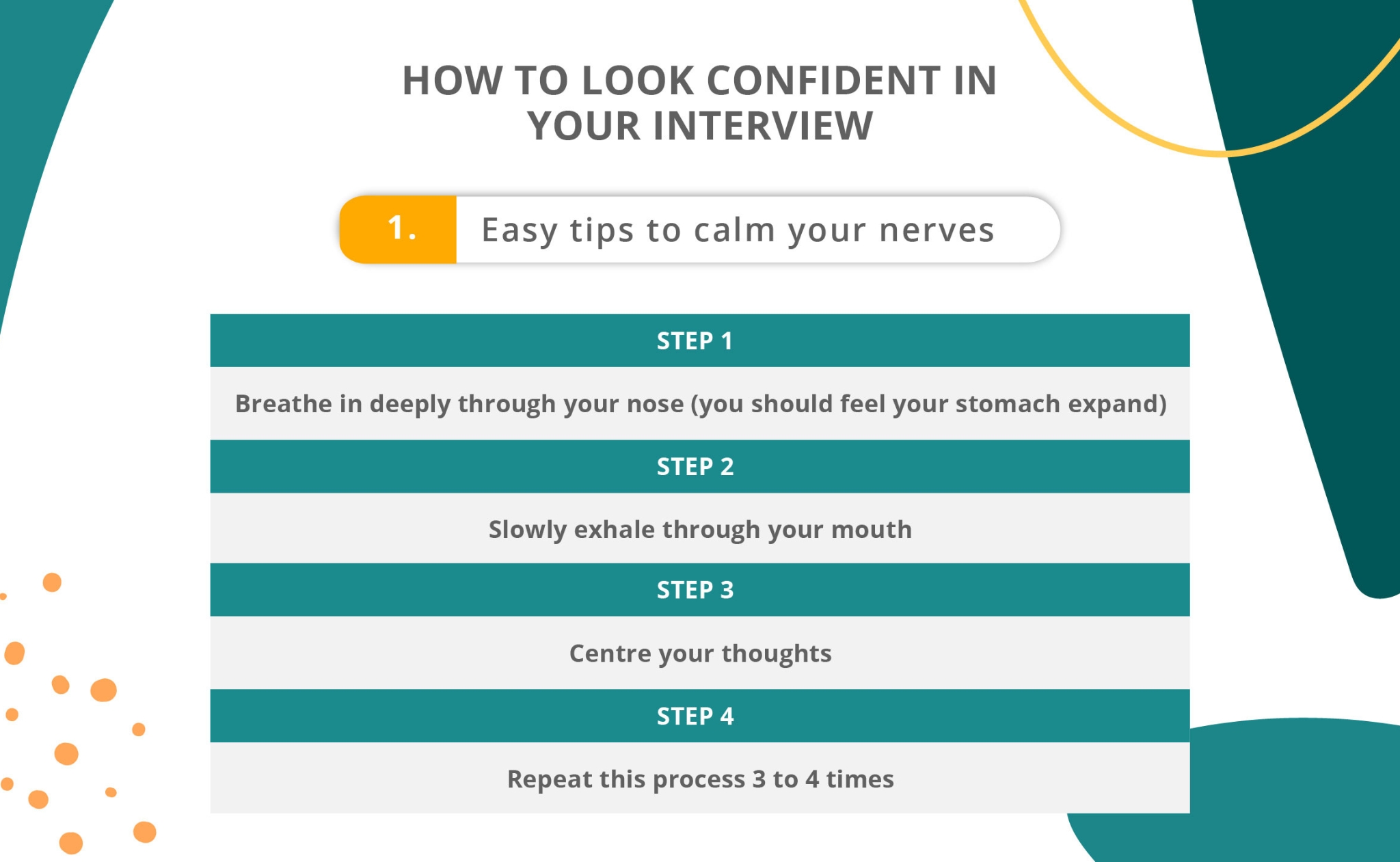

Bank of England has been working on a program to rebrand the UK’s financial services firms.

One of the ideas is to give the sector a sexier image, and the Bank of England chose to rebrand the financial services firms using their new logo, the Regulus.

By doing so they hope to improve the bank’s image, in the hope that would make it a more attractive place for businesses to do business with.

This rebranding effort by the Bank of England is part of the Department for Financial Institutions’ (DFI) efforts to improve the standing of the UK banking industry.

One of the reasons for this rebranding program is because many customers feel that the banks are not socially responsible and that they do not have a good reputation, particularly in the eyes of young people.

It’s thought that the rebranding could help to change this image.

Technology

Technology is advancing at a very fast rate and some of the banks are struggling to keep up with this rate of progress.

However, by developing new technology banks are looking to solve their customers’ needs.

By applying some of the new technologies, banks can ensure they have products and services that customers want to use.

One of the main areas that banks are hoping to use technology for is to increase security.

As technology is advancing so quickly and advances in digital technology have become commonplace, banks are looking to become more secure and have more secure technology.

For example, banks are looking at introducing biometrics to their services.

Biometrics can be used for security purposes such as providing customer information as well as allowing customers to access services.

The trend of using biometrics is not just limited to the banks however, other companies such as banks are looking at introducing more sophisticated security measures into their services.

However, it is not just banks that are looking to use new technology.

It is said that traditional service companies are also looking into using new technologies to solve the current problems facing them and to help improve customer experience.