One of the most critical choices a founder will have to make early on in their journey is sometimes forgotten in the excitement of establishing a new business: 1. Should I do it alone and have complete control, but be forced to bootstrap the company and develop it slowly, or 2. Should I bring in cofounders or investors to help finance and grow the company more quickly, but be forced to share decision-making power?

The Founder’s Dilemma is the decision between developing it yourself on a shoestring budget versus sharing control and accepting financing from others for fast development.

Many entrepreneurs have an overconfidence bias and believe they know everything. They desire full control over their company and to be the king of it.

Many entrepreneurs are drawn to the notion of managing an organization and telling people they are the President and CEO of a business more than the desire to be wealthy. Many entrepreneurs believe that they alone can lead their company.

“I’m the one who had the vision and desire to start a business,” they tell themselves. “I have to be the one in charge.” As a consequence, they want complete control over the course of events.

Most entrepreneurs have ultimate confidence in their skills, but the decision to do it alone is a personal one.

Founders are frequently naïve about the difficulties they would encounter later on in their journey during what I call the salad phase. For them, starting a company is a labor of passion.

They develop an emotional attachment to the company and begin to refer to it as “their baby” or use similar parental language without even realizing it.

If the enterprise can be readily bootstrapped, such as if you want to become a freelancer or establish a service-based company that doesn’t need much money or skills beyond technical expertise, then going it alone and choosing power and control is frequently a feasible choice. When the business need funding to acquire momentum, though, things become complicated.

Debt financing with friends and family

When a founder discovers that debt financing through a lending institution, such as a bank, is not an option, many entrepreneurs who value power and control above the possibility for more riches and fast development turn to friends and family for a loan. Taking on debt from friends and family comes with its own set of dangers.

Friendships and relationships may suffer if the endeavor fails to fulfill expectations and the company is unable to repay the loan according to the agreed-upon terms.

Quantitative variables like as collateral, cash flow, and financial ratios are highly weighted by institutional lenders. Essentially, they are concerned with financial matters.

Debt owed by friends and family members is often based on qualitative criteria such as the person’s relationship with the creator or the founder’s experience. After all, what parent doesn’t trust in their children’s ability to succeed?

What family member or close friend does not feel a feeling of moral responsibility or a sense of duty to assist another family member with a loan when asked?

If a founder gets loan funding from friends or family, they must conduct themselves professionally and handle the lender as if they were a traditional lender. They should create formal agreements and set reasonable payback expectations.

There are six elements to handling financing from friends and family, according to Martin Zwilling.

One of the most significant drawbacks of borrowing money from friends and family or a lending institution is that it is considered “dumb money.” The creator thinks they have all they need to succeed on their own. However, the founder often lacks certain talents and need assistance. Many entrepreneurs are technical specialists who lack the business acumen and leadership skills needed to start a company from the ground up, as Michael Gerber so eloquently stated in the e-Myth. The founder may be able to recruit the skills they need, but they are often unable to do so. As a result, the founder’s dilemma may include giving up some power in return for wise money.

Crowdfunding with a reward system

Raising money via a reward-based crowdfunding campaign may be a possibility if you value power and control over your company and have all of the abilities required to establish and manage a firm. Most reward-based crowdfunding is used to pre-sell a product, providing the company the funds it needs to produce and distribute its offering.

Crowdfunding isn’t as simple as setting up a campaign page and waiting for donations to come in. We recommend reading our Crowdfunding Primer for additional information on what it takes to launch a successful crowdfunding campaign.

Most entrepreneurs ultimately discover that their financial resources, ability to inspire others, and enthusiasm are insufficient to allow their businesses to fully exploit the potential.

Wealth and rapid growth – the founder’s dilemma

“I need your money and skills, and I’d be willing to take a smaller piece of a larger pie in exchange.”

Founders must find a balance between their desire to guide the business’s path and recruiting the finest resources to help it develop. The impression of a company’s potential is one element that affects a founder’s dilemma choice.

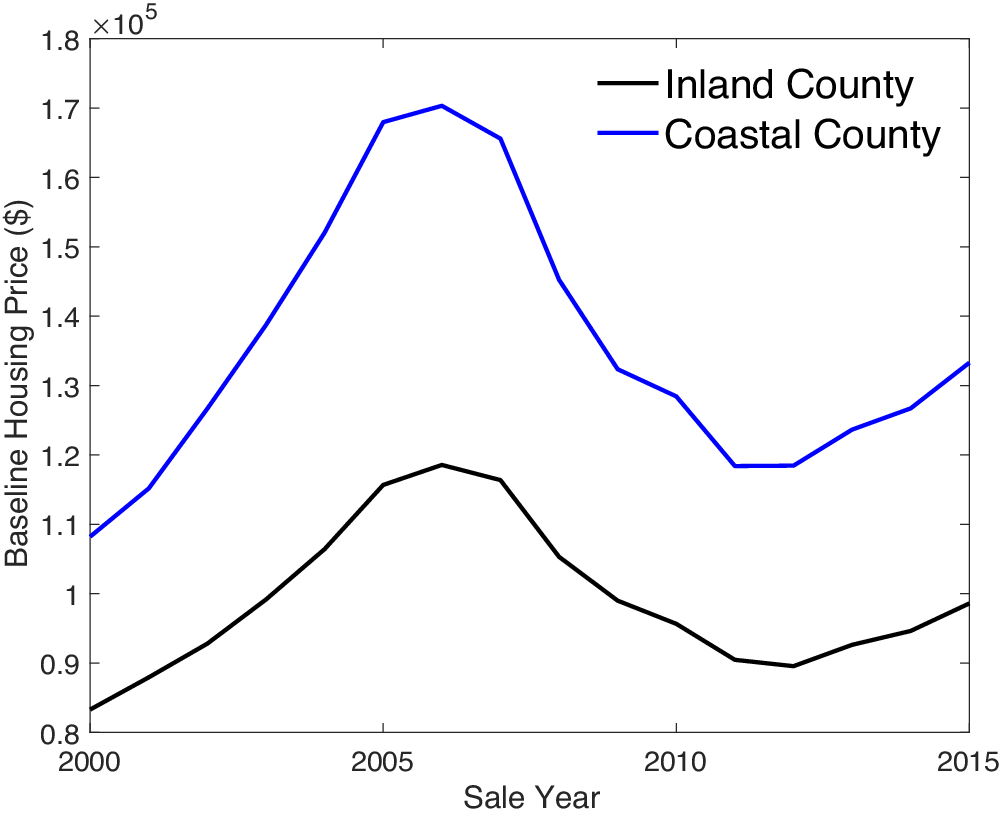

When founders think their company has the potential to develop into something very valuable, they frequently make different choices than when they believe their enterprises have a more modest potential.

Because it will take time for the firm to produce enough cash flow to repay any debt funding, many entrepreneurs are compelled to consider bringing on partners or investors in return for a share in the company. In return for recruiting the appropriate talent you can’t afford in the early stages of a firm or getting risk money from an investor, selling a share in the company or giving away equity entails giving up some control.

The sooner in the business the riskier it is, and the more ownership the entrepreneur will have to give up to attract top personnel or financing, as described in Raising Capital: A Lesson From The Ship Of Gold.

Equity among friends and family

While equity contributions from friends and family are occasionally feasible, they are almost always a waste of time. By virtue of their investment, they may have some power, but friends and family members typically lack the expertise or connections to assist leverage their investment.

Smart money sources offer more than simply money to the company, which is where the true value of smart money comes into play.

Equity as a partner or co-founder

When the entrepreneur realizes that they need assistance, they may consider bringing on partners. In a few instances, the creator will willingly give up ownership in return for a set of complimentary talents that they lack.

A technical founder, for example, may enlist the assistance of a sales and marketing partner. Because the venture is still in its early phases, the firm does not have enough cash flow to pay the partner what they are worth, therefore the founder must sell the company’s vision and give the partner an ownership stake in the company in order to persuade them to accompany them on their adventure.

Frequently, the company requires capital, and the partner is expected to invest in the endeavor.

When I established a documentation and training company, I faced the founder’s problem since I required $75,000 to get started.

I was only able to contribute $55,000 of the required starting money via a HELOC (home equity line of credit). If I ever wanted to get the company off the ground, I needed a source of extra money.

I conducted a personal SWOT analysis and found that I might need some assistance in many areas in order for the company to succeed. I knew I had skills in some areas but needed access to additional business skill sets and network contacts to truly make the most of my business venture.

Rather than pretending to be an expert in all business matters, I knew I had skills in some areas but needed access to additional business skill sets and network contacts to truly make the most of my business venture. I was able to connect with two business partners who each donated $20,000 to the total.

They contributed not just their network connections, but also their complementing talents and expertise as investors. With them on board, the company’s overall worth rose significantly.

This is the worth of wise money.

One of the most important business lessons I learned came from one of my mentors, who told me that when you bring on a partner, the value or price per share you give them does not have to be the same. Despite the fact that we were still in the early stages of growth, my two partners paid 40% more for the same share of stock as I did.

Investments made by angels

While partners assist with day-to-day operations, angel investors will exercise influence over the direction of the company since, after all, money is at risk even if they do not roll up their sleeves and get their hands filthy with the day-to-day operations. Angel investors are seen to be wise money since they often have significant connections and expertise that they may utilize to leverage their investment.

Angel investors, unlike relatives and family members, are never silent partners.

Other than that, angel investors vary from partners in that they are more sophisticated. They’ve frequently invested in other companies and know how to create favorable circumstances.

To reduce risk, they may insist on a board of directors comprised entirely of their colleagues, or they may utilize more sophisticated financing mechanisms such as convertible promissory notes or SAFE agreements. Founders often agree to conditions that eventually come back to haunt them because they are too emotionally invested in the business, have an overconfidence bias, and are unaware of some of the complexities that the future would always bring.

Easy short-term decisions often turn into long-term issues; nevertheless, this is not to imply that angel investors should be shunned. Angel investors are often the greatest option for growing a larger pie quicker.

Thanks to Mahipal Nehra at Business 2 Community whose reporting provided the original basis for this story.