Without conducting a thorough study, I believe the majority of individuals would prefer not to spend their leisure time checking their money. Wouldn’t it be more fun to meet up with friends, play with your kids, or root for your favorite sports team?

You would, of course. However, this is one of those necessary evils that we must all do in order to avoid a chaotic and hectic existence as well as to safeguard your financial future.

If it’s any consolation, keeping on top of your money isn’t all that difficult or time-consuming once you get the ball rolling.

Make a list of your objectives

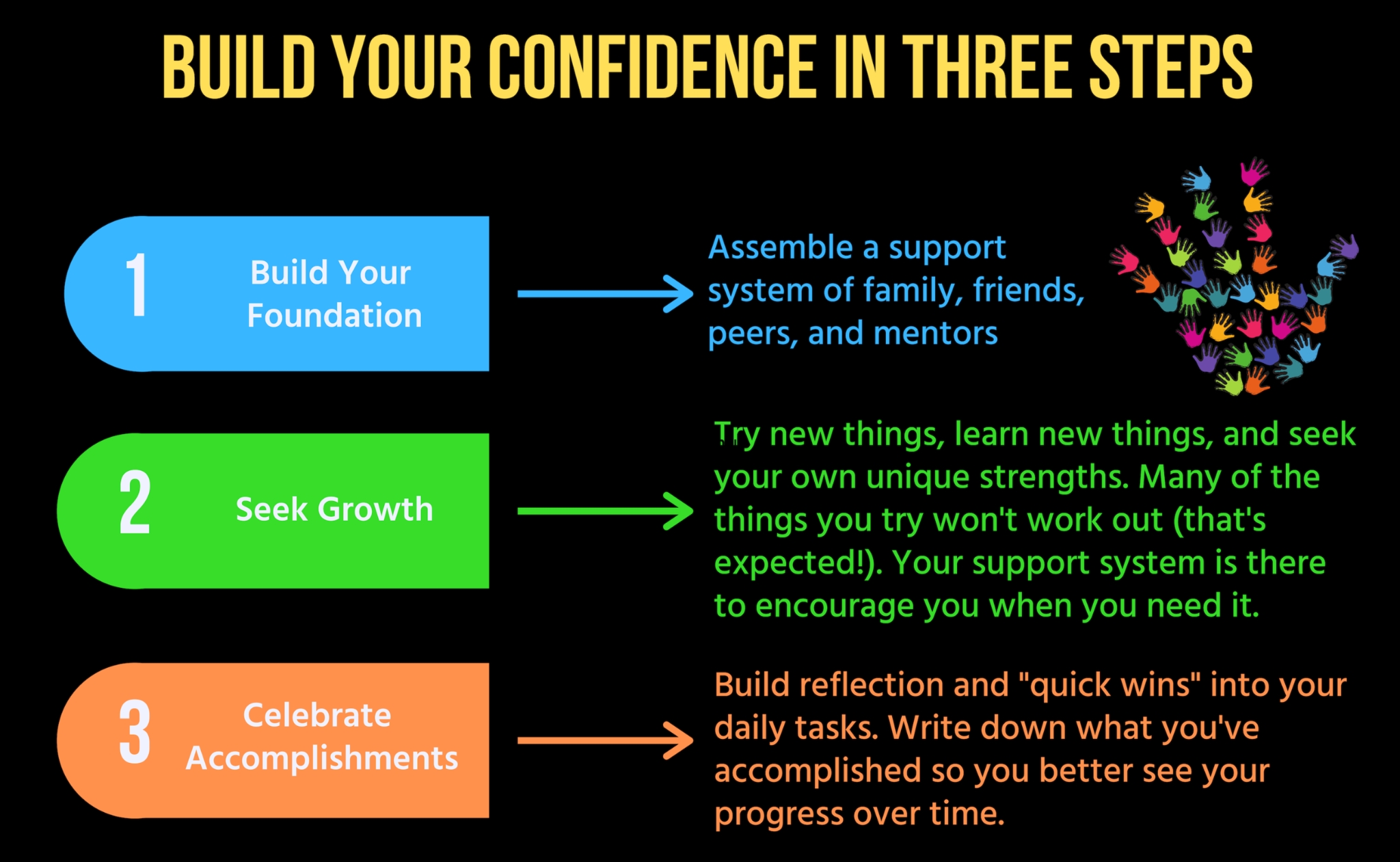

A good method is to write out your objectives. According to a research conducted by Dr. Gail Matthews, a psychology professor at Dominican University of California, this is the case.

Men and women from all areas of life, ranging in age from 23 to 72, were included in Mathew’s sample. One set of participants made a list of their objectives, whereas the other did not. What were the outcomes?

Participants who put their objectives down were more likely to achieve them. Furthermore, writing down your objectives and ambitions on a regular basis improves your chances of reaching them by 42%.

Why? It’s possible that this is due to the fact that it makes intangibles more tangible. Additionally, writing the objective serves as a visual reminder and helps us recall and keep the goal in mind.

In a nutshell, figure out what financial priorities you want to concentrate on and write them down as completely as possible. Sure, the most typical financial objectives people have, like as purchasing a home, establishing a company, and retiring early, need long-term preparation.

Regardless, determining your aim is the first stage in any approach.

If writing down your objectives isn’t enough, consider sharing them with others. Matthews also discovered that 70% of participants who shared their weekly accomplishments with a buddy reported achieving their goals (completing their goal of being more than halfway there).

Only 35% of those who kept their aims to themselves were able to achieve some level of accomplishment.

Make a reasonable plan

You want to make a strategy now that you’ve documented or communicated your objectives. However, this might be difficult at times. “The goal you set must be challenging,” Rick Hanson once stated.

At the same time, it must be reasonable and achievable, not unattainable. It should be difficult enough to make you stretch, but not to the point of breaking you.”

Furthermore, a solid strategy considers both short- and long-term objectives. Along the road, don’t forget to add numerous milestones and incentives.

If you fall behind, you may still monitor your progress using checkpoints to keep yourself motivated. Similarly, even if you fall a few rungs, you’ll still be able to track your progress.

Having a strategy raises your chances of success by more than 30%. You may also monitor the achievements and accomplishments of numerous objectives at the same time by defining short- and long-term goals and ranking their relevance.

You should be able to live on less than you earn

What’s the good news? A budget is used by 80% of individuals. What’s the bad news? The average American overspends $7,400 each year.

This should not be taken lightly, given that over 40% of Americans with yearly salaries above $100,000 live paycheck to paycheck. There are, thankfully, efficient strategies to guarantee that you live within your means.

The 50/30/20 rule should be followed. Simply split your after-tax take-home income into the following three categories: 50 percent for necessities, 30 percent for desires, and 20% for savings.

- Make your savings automatic. Set up an automated deposit of a portion of your paycheck into a separate savings account.

- Begin to own and then let go of your possessions. Don’t charge purchases on a credit card if you can’t pay off the debt.

- Spending that isn’t necessary should be avoided. I’m referring to the gym membership you don’t use, buying lunch every day, or just purchasing new items.

- Make no attempt to keep up with the Joneses. Stop drowning yourself in debt because you’re afraid of missing out.

- Continue to put yourself first. If you’ve paid off your debt, put the money into an emergency fund or a savings account that pays interest.

- Defer satisfaction if possible. Ilene Strauss Cohen, Ph.D. notes, “Being able to delay satisfaction isn’t the easiest skill to acquire.” “It entails dissatisfaction, which is why it appears impossible for people who haven’t mastered impulse control.”

- Change the kind of debt you have. Inquire with your lenders to see if you can get a better interest rate.

- Increase your earnings. If you have the time, acquire a second source of income until you’ve attained your financial target.

Sign up for paperless billing

Want to clear up some space in your life while simultaneously ensuring that you never miss another payment? Wherever possible, go paperless.

You can keep organized without dealing with an infinite mound of papers if you get fewer contact from stores and creditors. It’s also an easy method to make a little difference on the environment.

You should also set up automatic payments. If you’re afraid about forgetting about it, keep a separate bank account for bills exclusively. You’ll have enough money in this account to pay your expenses without incurring an overdraft charge.

All of your bills should be kept in one location

Even if you get most of your bills online, you should set aside room in your mailbox for invoices that come in the mail. Property tax and homeowners’ insurance invoices, for example, are normally sent to you once or twice a year.

You’ll also get periodic bills in the mail, such as medical bills or home repair costs.

Keeping your bills handy to your desk, or wherever you regularly write a check or pay bills online, can aid in your organization. A few folders or file cabinets would suffice.

Shredded paper statements and online records are becoming the standard as more individuals pay their bills online. You may retain any important paper documents in this file system for tax reasons or merely to be secure. If you like, you may even scan them and keep them online.

Take control of your finances

Setting debt repayment objectives as one of your top priorities is a good idea. After all, the average consumer debt in the United States is $92,727.

To be honest, not all debt is a negative thing. Student debts, a home, or establishing your own company, for example, are all instances of positive debt.

Having too much debt, on the other hand, may be harmful to your health and well-being, as well as prohibit you from achieving objectives like traveling or retiring early.

It’s easy to feel overwhelmed when you’re in a lot of debt. Developing a debt-reduction strategy, on the other hand, may make this more feasible.

Rather of making the minimum payment on all of your debt at once, focus on paying off one obligation at a time. Prioritize paying off your loans with the highest interest rates or the most harmful attributes.

After you’ve paid off your first loan, go on to the next and repeat the process. Paying off debt in this manner is known as the “snowball effect,” and it may be incredibly beneficial in reducing your debt.

Make a little investment

Are your coins strewn throughout your center console? Do you keep discovering $5 dollars in your old trousers or jacket that you haven’t worn in a year?

Put them, along with a little extra dollars from each of your paychecks, into a savings account. These micro-deposits will not be forgotten. They may also be used towards a dream trip or an emergency fund.

Downloading round-up savings applications is also a good idea. Acorns, Chime, Qapital, and Digit are among examples.

Keep track of your receipts and go through them once a week

Keeping track of your costs is just as important as keeping track of your earnings. As a result, instead of tossing receipts into the garbage, make it a practice to save them. Then go through them once a week to examine your spending patterns.

There’s another advantage to accumulating and organizing your receipts on a regular basis. You’ll be ahead of the game when tax season begins. You won’t spend time frantically hunting for receipts that you need to claim a deduction if you know exactly where they are.

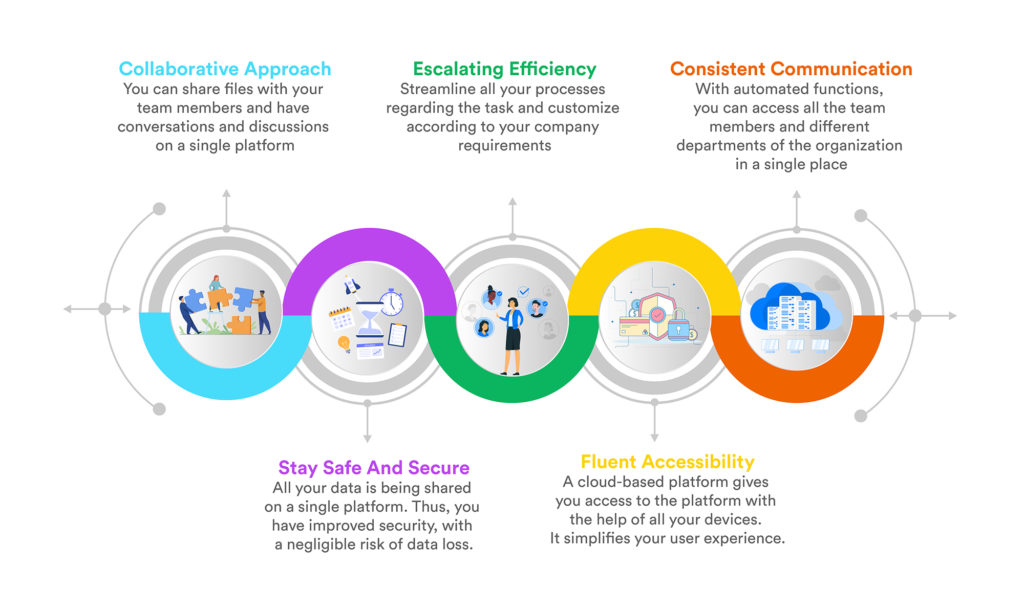

Make use of a budgeting app

Investing isn’t the only thing that financial software can do. On the internet, you may discover free budgeting tools to help you keep track of your daily, home, or company spending.

Check the app store’s reviews or the Better Business Bureau’s website to see whether the budgeting app you’re considering has a solid reputation with consumers.

At the conclusion of the month, do a review

Calculate your total spending and total income to see whether you’ve exceeded or fallen short of your monthly budget. Consider how and where you spend your money. Is there anything you could do without?

Have you made as much money in the past as you have in the past? Examine your profits and make informed financial choices in the future.

It’s simple to keep track of your personal money if you follow these guidelines. It also guarantees that your attempts to keep on top of your money are constant.