When you run a small company, it may be tough to keep your personal and business money distinct. If your company is set up as a sole proprietorship, keeping your finances separated may be particularly difficult. There is no legal distinction between you and the company since a sole proprietorship is regarded a nonentity.

However, whether you’re forming a Limited Liability Company (LLC) or a corporation, you’ll need to open separate business bank accounts.

Separating the two, regardless of how your company is set up, can provide difficulties and may even result in legal issues. Separating personal and business expenditures, on the other hand, greatly simplifies your life by saving you both time and money. It’s also not as tough as you would think.

Identifying the Difference Between Personal and Business Expenses

Before we can separate personal and commercial expenditures, we must first understand how they are characterized. Businesses may claim tax deductions for business expenditures, according to the IRS. The following are examples of company expenses:

“Both ordinary and essential.” In your profession or company, an average expenditure is one that is usual and acceptable. A required expenditure is one that is beneficial to your profession or company.

To be deemed essential, an expenditure does not have to be absolutely necessary.”

The difference between business and personal expenditures is usually quite obvious.

Why do you need to keep your personal and business finances separate? Let’s take a short look at why it’s critical to keep your company and personal money separate.

There are tax implications

One of the most compelling reasons to keep your personal and company money separate is to reduce your tax liability. Company expenditures like office supplies and travel, for example, are tax deductible for business owners. To claim these deductions, you must have sufficient supporting documents, such as receipts.

During an IRS audit, they’ll go through every expenditure to make sure it’s related to your company. Keeping accurate records of company expenditures and how you paid for them can ease this procedure if you have a separate business account.

Personal assets are at risk

It is essential to establish your company’s structure in order to provide legal protection. Your risk, responsibility, and tax obligations are all determined by the legal structure you select for your company. One of the reasons company owners form an LLC or corporation is to protect their personal assets.

Even though your company structure shields you legally, you may still be held personally responsible for business debts if you’re sued and the court can’t properly separate your business and personal funds.

If you don’t separate your company and personal funds, a court may be able to “pierce the corporate veil,” meaning your assets may be confiscated. In certain cases, creditors may go after your personal assets, such as your bank account, investments, house, or other belongings, to recover outstanding company obligations.

You may prevent this scenario by keeping a separate account for business expenditures. Similarly, you should never deposit business checks into your personal account. In summary, by keeping your company and personal accounts separate, you can protect your personal assets.

Building a credit history for your company (and qualifying for financing)

It’s also crucial to keep your company and personal credit records distinct. Lenders will look at your personal creditworthiness as well as your company’s credit repayment history.

Why?

You’ll need to open separate accounts in the business’s name to establish it as a distinct entity with its own credit history and one that differs from your personal credit history.

Maintaining records is simple

It may be time-consuming and unpleasant to go through your personal records for company purchases or payments to monitor. Keeping things segregated is the greatest approach to save time while also preserving your sanity.

Furthermore, this may assist you in gaining a better understanding of your cash flow. This also makes keeping track of expenditures a snap. It also gives you some much-needed peace of mind.

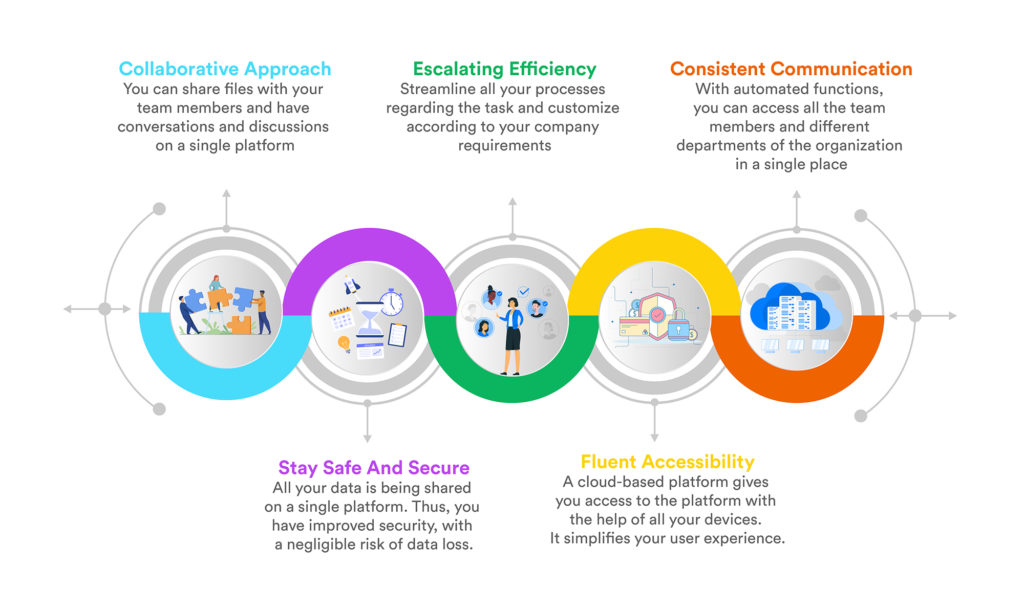

More characteristics that are important

Business accounts, whether checking, savings, or debit and credit cards, are set up substantially differently from personal accounts. Some of the services offered for business accounts include accounting integration, cashback for companies, and bank account administration.

Let’s talk about how you can keep your company and personal money separate now that we’ve covered why it’s so important.

Register your company

What’s your first move? Register your company with the government.

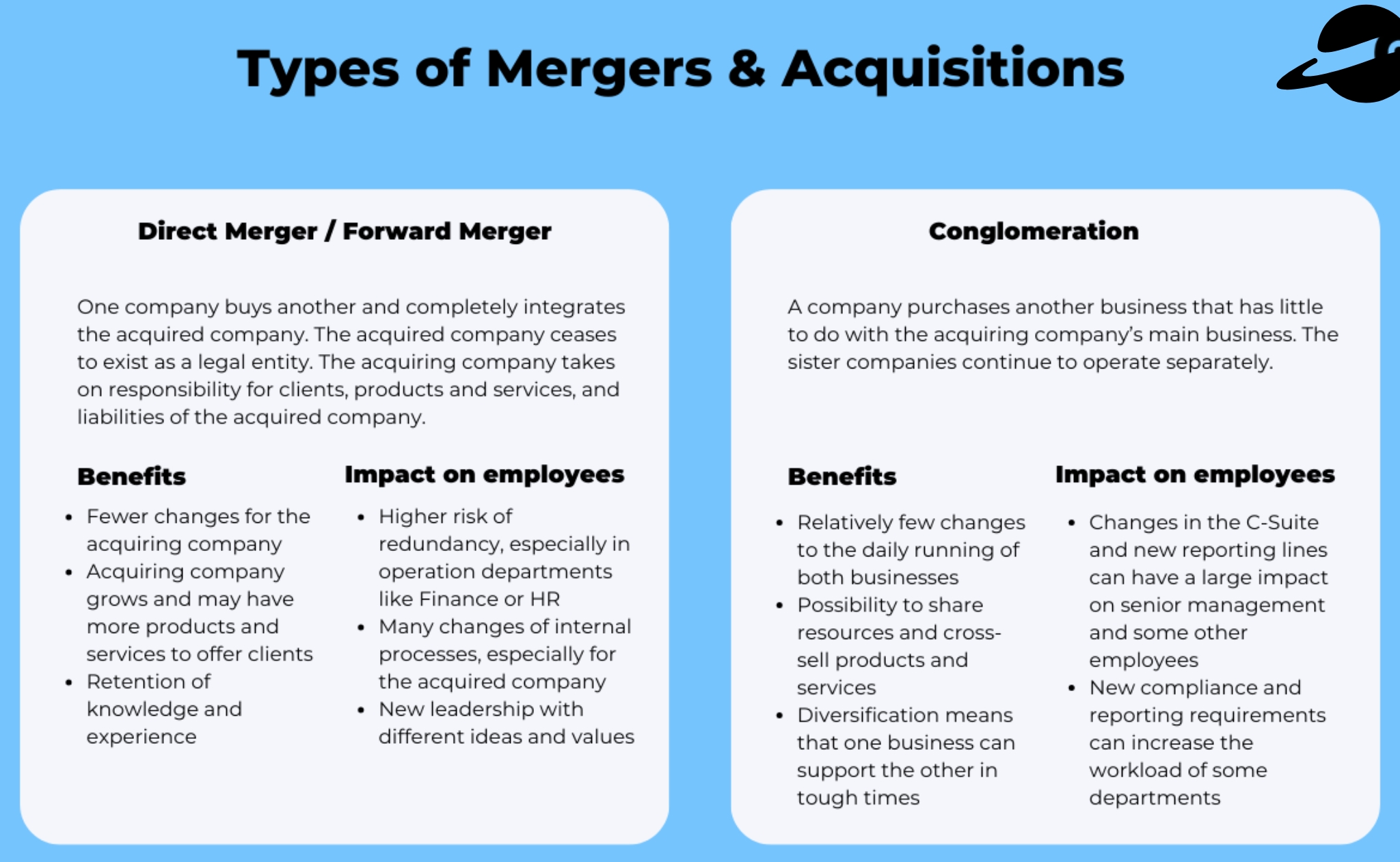

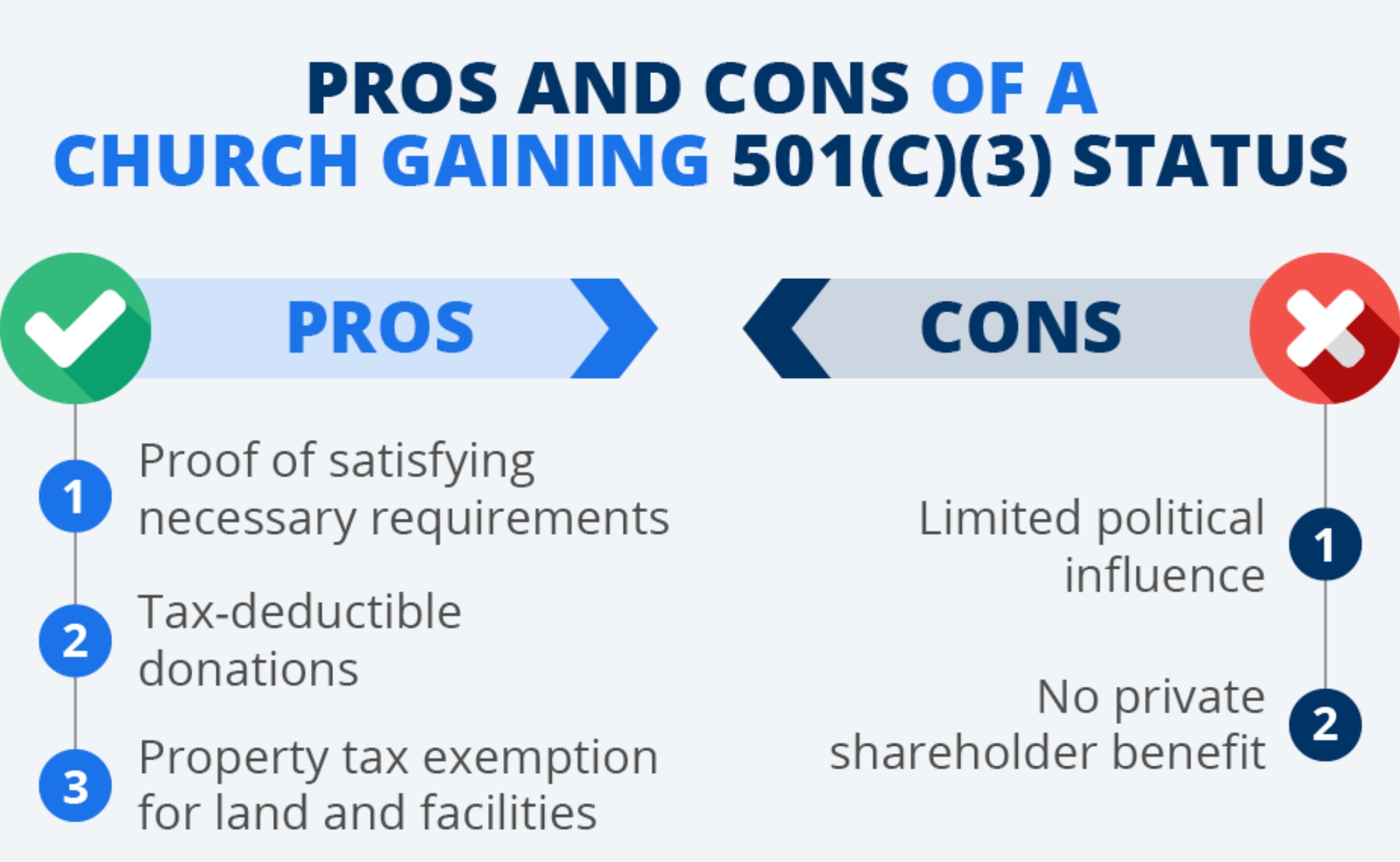

As you may be aware, there are many company structures to choose from. You must be cautious when choosing your company structure since it affects your ability to obtain money, the amount of taxes you pay, and your personal responsibility. You have a distinct legal identity from all other shareholders in your firm whether you structure your business as a corporation, a limited liability company, or a S corporation.

The most important protection against liability for its owners is incorporation, which also improves an organization’s reputation and financial availability. This kind of company organization, however, is also more expensive. Additional administrative procedures, greater taxes, and more stringent recordkeeping are all contributing to the increased cost.

Make careful to do your homework before registering your company. If you’re stuck, I’d suggest reading the US Small Company Administration’s instructions to establishing a business.

Obtain an Employee Identification Number (EIN) (EIN)

EINs are similar to social security numbers for businesses. You’ll need an EIN to keep your social security number distinct from your company activities and paperwork. When you register your company with the IRS, the IRS will give you a unique nine-digit number.

This number may be used for business-related tax-related operations as well as opening a bank account. It’s a great method to keep your personal and corporate assets separate, and it also protects you from identity theft.

The application for an EIN is completely free and takes just a few minutes to complete on the IRS website.

Open a bank account for your company

You may seek additional advice from a banking expert after you’ve decided what products and services you need for your company finances. You may establish a dedicated account after you’ve figured out what your bank has to offer and how it might help your company.

What if you’re a single owner with a fictitious business name? You must register your business with your state in order to establish a bank account in its name. The bank will next utilize your Employer Identification Number (EIN) to establish your company account.

Think about getting a company credit card

A corporate credit card, although optional, is another method to keep track of business expenditures and separate business and personal transactions. When it comes to seeking tax deductions, having several accounts may be beneficial.

Furthermore, by properly utilizing your business credit card, you will be establishing distinct company and personal credit. First, choose a card that meets your company’s requirements. You can discover cards with no annual fees or that provide cashback or travel incentives, for example.

Consider your payment patterns, such as whether you’ll pay off the amount each month and if your workers will be able to use the cards.

Set up utility accounts in the name of the business

Utility services should be paid for in the name of your company. Business telephones, mobile phones, the internet, and power should all be covered.

These service accounts must be managed since they are the monthly expenditures that your company incurs.

Keep track of your receipts and expenditures

Looking through your bank account statements may take hours if you don’t separate your personal and company money. As a result, a significant expenditure in ibuprofen may be necessary.

Again, having separate bank statements for company and personal accounts is advantageous in this situation. You may check the financial records of your company by examining your monthly and end-of-year statements, such as how much you spent and what business expenditures to cut, by analyzing your monthly and end-of-year statements.

Make an income for yourself

Paying oneself a salary makes it simpler to draw a formal line between your company and personal money. Then, once or twice a month, transfer money from your company account to your personal checking account as though you were working for someone else.

Instead of utilizing your company money whenever you need them, if you pay yourself a salary, you decide when and how you will take funds from your firm.

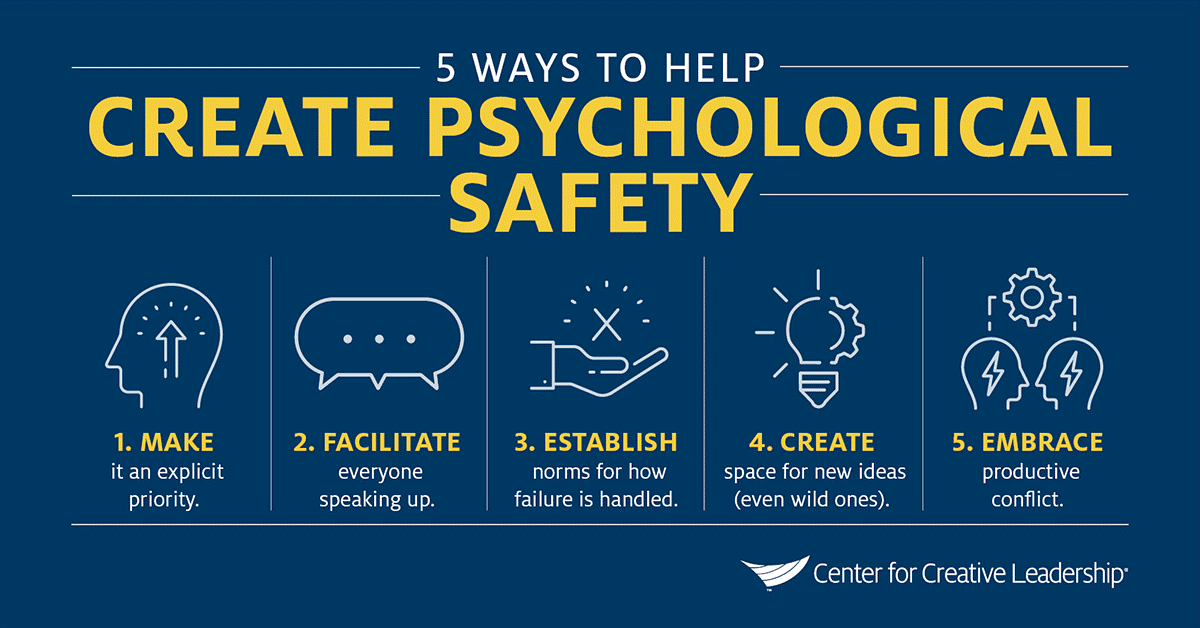

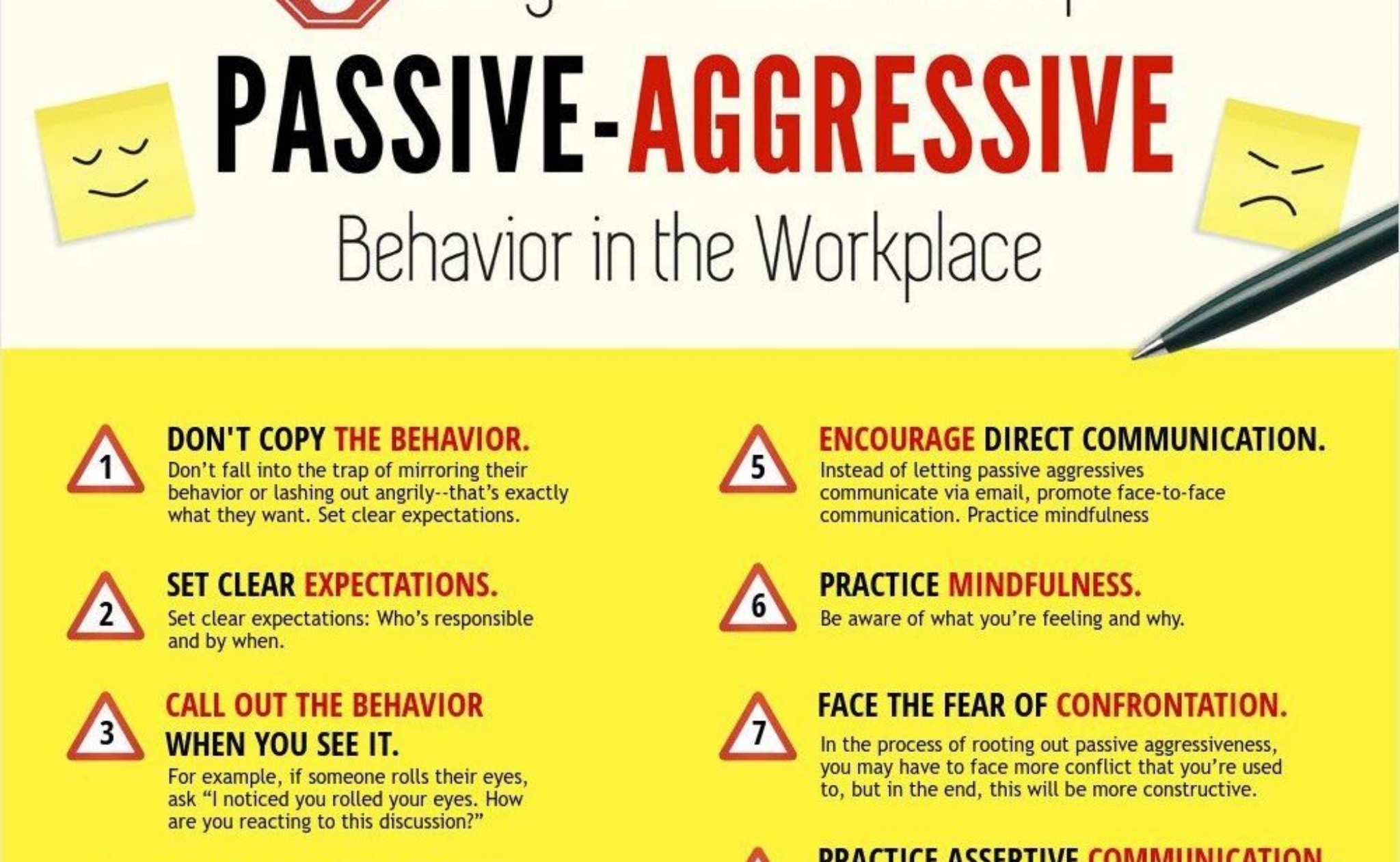

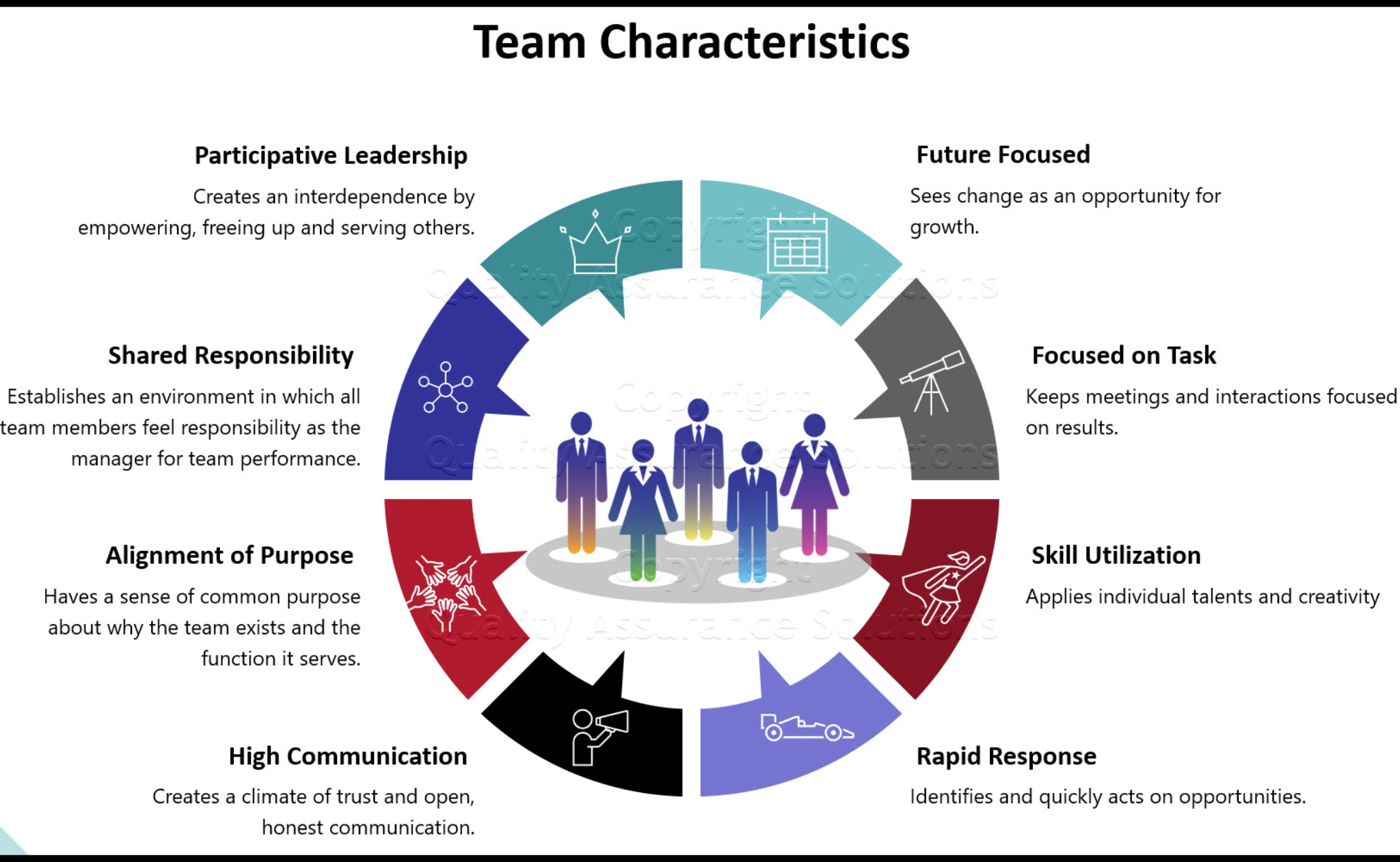

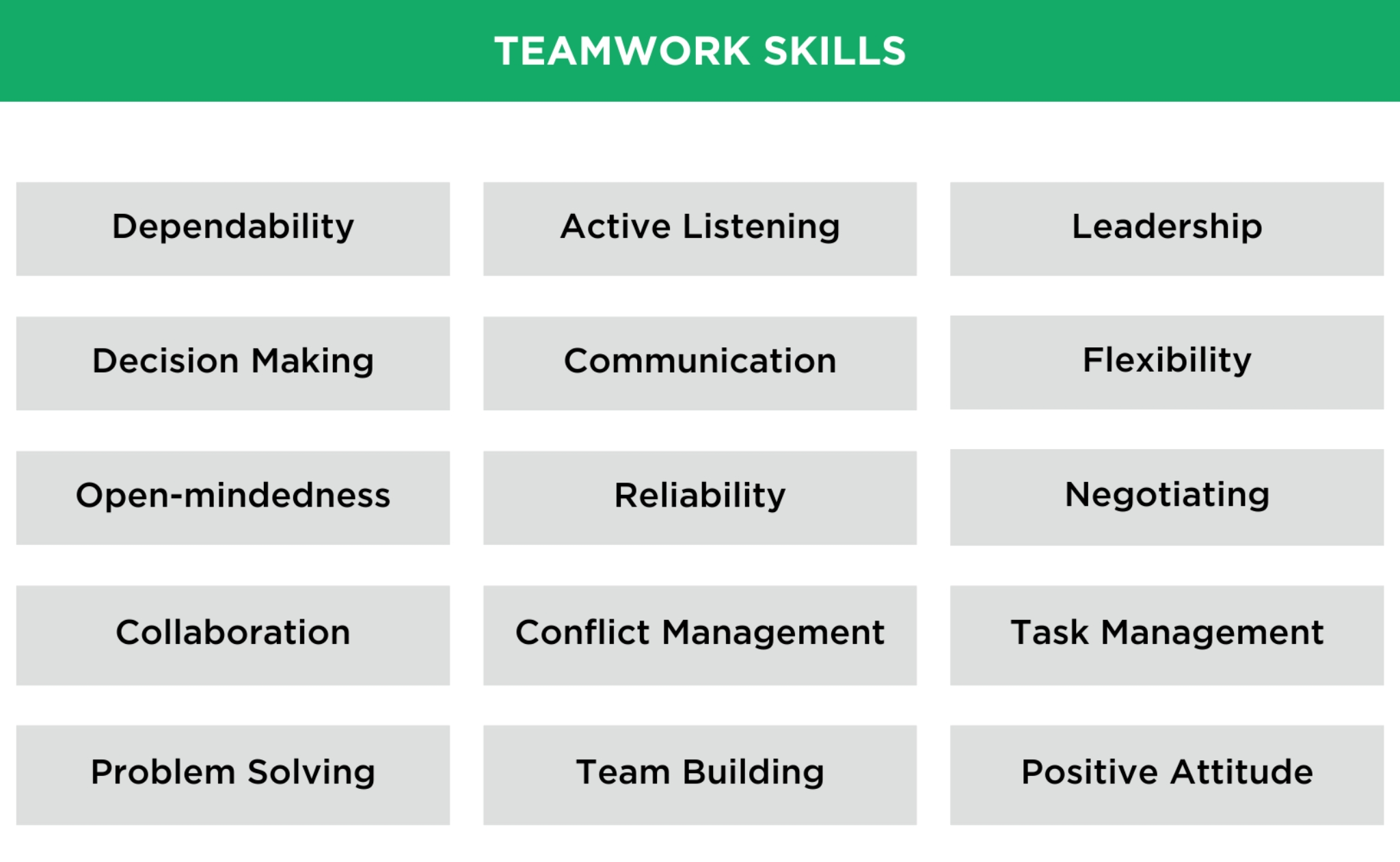

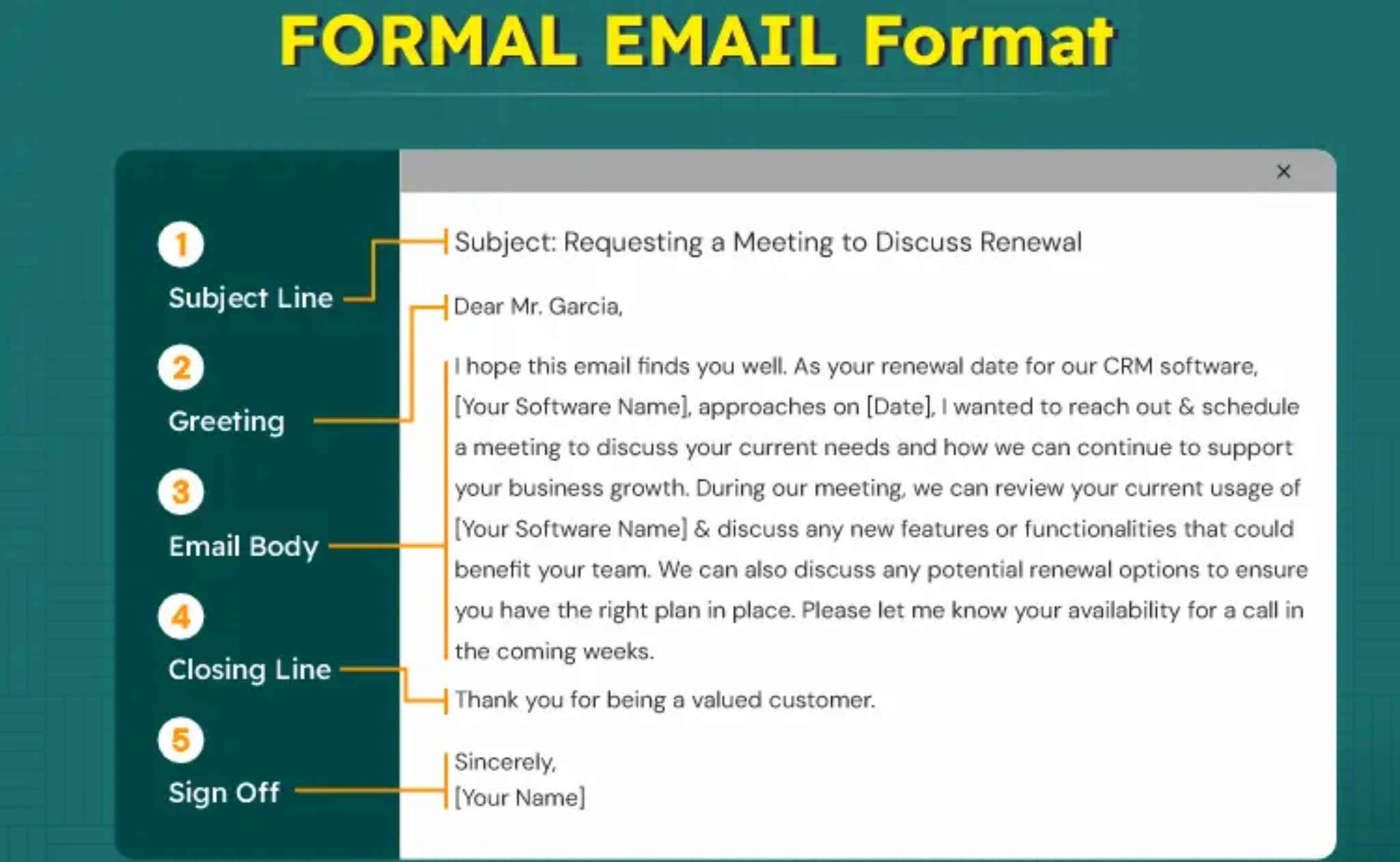

Others in the company should be educated

Before separating company and personal money, we must ensure that all business stakeholders are on the same page. If other members of your team aren’t on board, separating your personal and company money won’t make a difference. In an all-hands-on-deck approach, everyone engaged in the choices has to be with you.

Establish a framework to assist individuals in distinguishing between company and personal money and ensuring that everyone understands the differences.

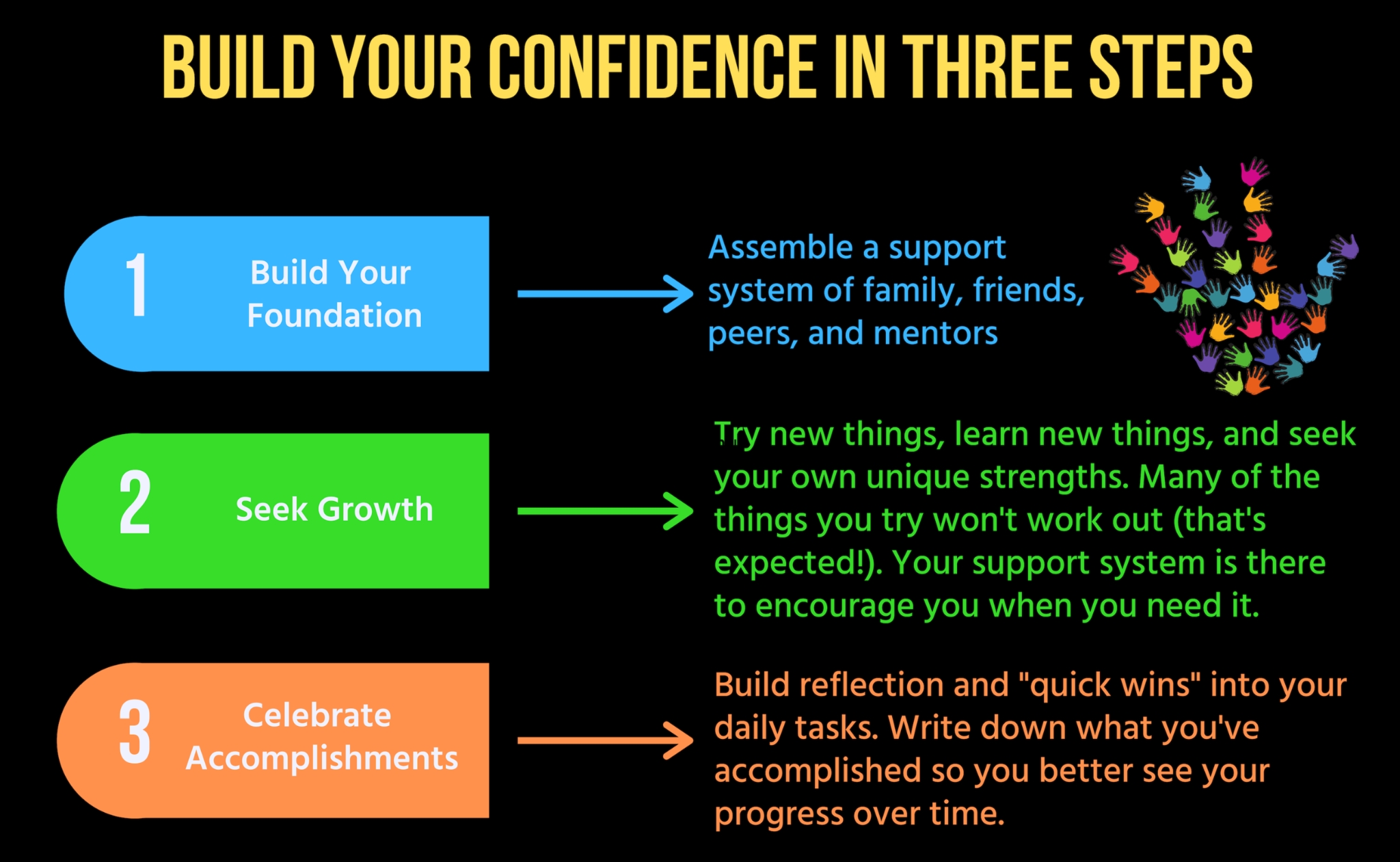

Final thoughts

It’s important not to overlook the value of using a simple technique to figure out how much money your company makes. In fact, if you hire a bookkeeper or accountant, they will insist on keeping your business and personal money separate. After all, it just makes life simpler.

The best part? After you’ve completed the necessary legwork of separating your company and personal money, you’re ready to start.

Thanks to JohnRampton at Business 2 Community whose reporting provided the original basis for this story.