Fixed income refers to an investment in which the issuer or borrower makes payments on a predetermined schedule and for a predetermined amount.

It may, however, be interpreted in a different way. This phrase may also apply to income from pensions or preferred stocks, both of which are fixed income sources. They don’t change.

What is the difference between a fixed income investment and a variable income investment?

The rate of return on a fixed-income investment is predetermined or fixed. The interest is produced over a certain length of time in this case.

They are preferred over derivatives and stocks because they provide set returns on investments.

What Are the Advantages of Having a Fixed Income?

Some of the advantages of a fixed income are listed below.

- Lower Risk: Compared to stocks, they are less prone to hazards since they provide a set amount of return on investment. Fixed-income investments are usually unaffected by macroeconomic fluctuations, which is one of the main reasons for this.

- You may devote part of your stock portfolio to fixed-income assets if you have a large number of equities in your portfolio. You may avoid large losses such as stock market swings by devoting a portion of your portfolio to fixed-income assets.

- Capital Preservation: Capital preservation refers to preserving the absolute value of your investment by investing in assets with a specified return of primary objective. Fixed income investments are highly suggested for individuals who are close to retirement since they carry less risk. Because they don’t have a lot of time to deal with their losses, this may be a source of revenue.

- Income Generation: They may supply you with a steady stream of income since they provide a set return on investment.

- Total Returns: Some fixed-income assets have the potential to generate significant profits. Taking on more credit risk or interest rate risk may help investors make more money.

What are the Consequences of Investing in Fixed Income?

The four main hazards associated with fixed income are listed below.

- Interest Rate: If the interest rate increases, bond prices will decrease. Your bonds’ value will drop as a result of this.

- Inflation: While fixed income investment provides a set rate of return, it may become problematic if inflation outpaces fixed income.

- Credit Risk: Purchasing corporate bonds exposes you to both credit and interest rate risk. Credit risk refers to the possibility of an issuer failing on its debt commitments. In this case, the investor may not get the entire value of the original investment.

- Liquidity Risk: When an investor wants to sell a fixed income asset but cannot find a buyer, they are considered to be experiencing liquidity risk.

Fixed-Income Assets

1. Temporary

Low-rate returns are available with this kind of fixed income. This is due to the fact that you are only needed to commit money for a few months.

Low returns are also one of the reasons why many investors have switched from short-term to long-term investments.

It’s utilized to manage the cash flow that’s needed for day-to-day operations.

- Savings Account: You’ll get a set interest rate based on the fed fund rate. You have complete freedom to withdraw anytime you choose.

- Money Market Accounts: The interest rate on these accounts is somewhat greater than on savings accounts. However, you must maintain a specific quantity deposited. The disadvantage is that the number of transactions allowed each year is restricted.

- Certificates of Deposit: You must keep your money invested for a certain length of time in order to get the set rate of return.

- Money Market Funds: Money Market Funds are a kind of mutual fund that invests in short-term assets. You are paid a set rate based on short-term securities. Treasury banknotes, federal agency notes, and eurodollar deposits are all included.

- Short-term Bond Funds: These are mutual funds that invest in bonds that have a maturity of one to four years.

2. Long-term planning

A bond is another name for this kind of investment. It refers to a debt arrangement involving two parties: the issuer and the investor.

The interest rate is primarily determined by treasury rates, as well as the credit and duration risk that the issuance entails.

The many kinds of bonds are listed below.

- Government Bonds: Because they are guaranteed, government bonds are the safest and most secure. This is why they have the lowest rate of return.

- Corporate bonds have a somewhat higher interest rate. Companies often sell these when they need funds but do not want to issue shares.

- Convertible Bonds: As the name implies, convertible bonds may be changed into stocks.

- Eurobonds: Eurodollar bonds are also known as eurobonds. Foreign bonds that are not denominated in the domestic currency of the market in which they are issued are known as non-domestic bonds. For example, Asian businesses issuing bonds in South Africa use US dollars as their currency.

3. Derivatives of Fixed Income

The value of many financial derivatives is dependent on fixed-income products. Big investors and corporations utilize them to avoid losses.

- Options: An option is a derivative contract that provides the buyer the power to trade a bond at a set price within a certain timeframe. For the same, a buyer is permitted by options. They are traded on a controlled exchange.

- Future Contracts are similar to options in that they are based on the future. The main difference between them and options is that the buyer is obligated to complete the transaction. They are bought and sold on a stock exchange.

- Forward contracts are contracts that are made in the future. These are comparable to future contracts once again. Future and forward contracts are only distinguished by the fact that they are not traded on an exchange.

The method used here is Over The Counter (OTC), which may be done between two people or via a bank.

- Mortgage-backed securities are backed by a mortgage. Because they’re made up of a number of home loans, they’re very valuable.

They, like bonds, provide a rate of return depending on treasury rates as well as the risks associated with the underlying assets.

- Debt Obligations with Collateral: These are comprised of a number of different underlying assets. Corporate bank loans, vehicle loans, and credit card loans are examples of these.

- Asset-Backed Commercial Paper (ABCP): These are one-year corporate bond packages. Real estate, corporate car fleets, and other company property are included.

- Swaps of Interest Rates: Swaps of interest rates are a kind of derivative transaction. It’s a deal between two parties to exchange all future interest rate payments from a bond or loan. It may happen to businesses, banks, or investors.

Fixed-Income Payment Streams from Third Parties

Some fixed income sources are unaffected by the amount of money invested. The payment is guaranteed by a third party in this case.

After a specific period of time has elapsed, Social Security benefits become accessible. It’s guaranteed by the federal government and based on your tax payments.

It is managed by the Social Security Trust Fund.

- Pensions: Your company guarantees you a set payout when you retire based on the number of years you worked as an employee and your income. These days, there are very few businesses and industries that provide this service.

- Fixed-Rate Annuities: Fixed-Rate Annuities are insurance products that guarantee a fixed payout for a certain period of time. These are on the increase as a consequence of fewer employees getting pensions.

What is the Best Way to Invest in Fixed Income?

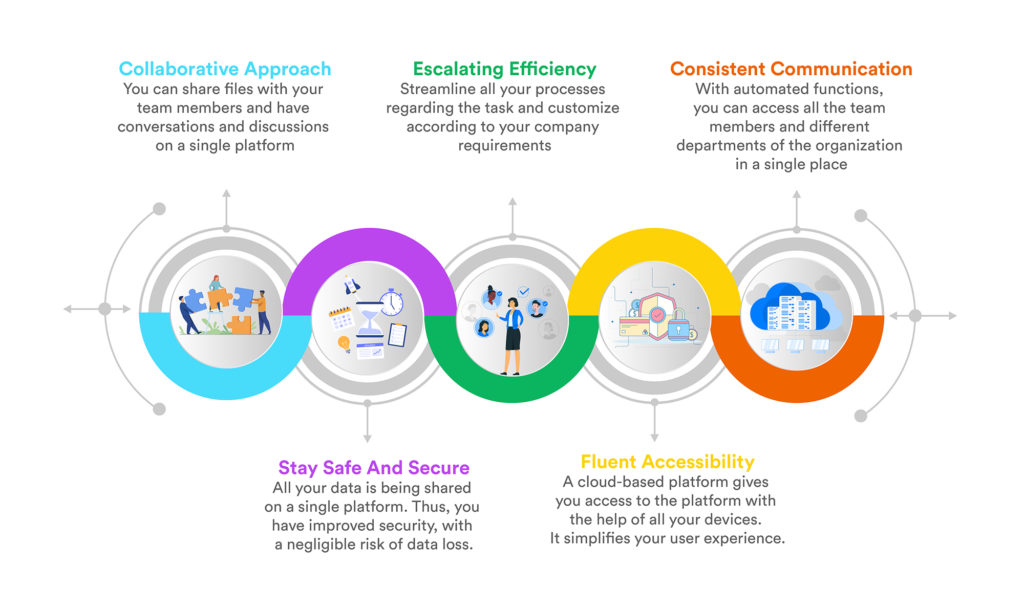

You may invest in fixed income via mutual funds and exchange-traded funds as an individual.

A single bond or other fixed-income asset may also be purchased by an individual investor. To build a diversified portfolio of individual bonds in this manner, you’ll need a substantial quantity of assets.

Individual investors, on the other hand, often encounter certain challenges while investing in fixed income. Large minimum investment requirements, high transaction fees, and a lack of liquidity in the bond market are just a few examples.

Its Economic Consequences

The economic effect of fixed income may be summarized as follows:

Companies utilize bond markets to obtain money to develop and grow their businesses. They use money market instruments to get the cash they require for day-to-day operations.

Money market instruments are short-term securities that provide significant amounts of money at a cheap cost to companies, banks, and the government.

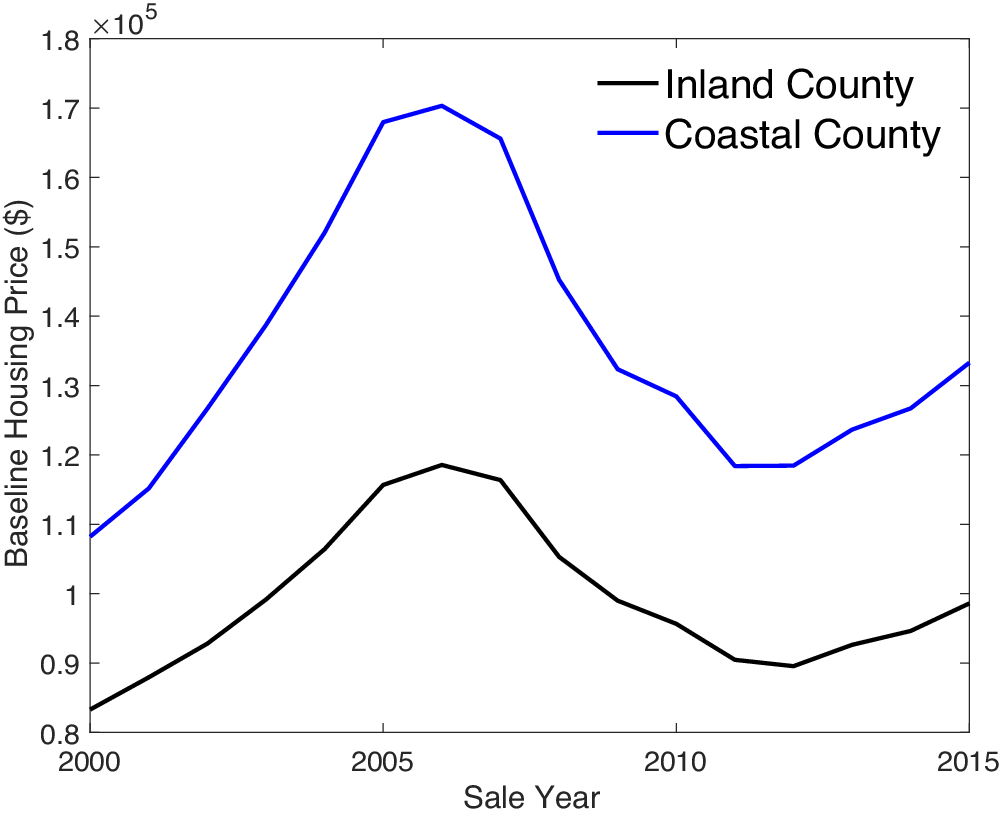

Treasury bills, notes, and bonds are used to calculate other interest rates. The production and Treasury bills are inversely proportional.

When demand for Treasury Bills decreases, production tends to increase. Then, on other fixed-income instruments, investors want greater interest rates.

Thanks to Mahipal Nehra at Business 2 Community whose reporting provided the original basis for this story.