Data interoperability has become a need in an algorithm-driven society, particularly in the financial sector. Banks and other financial organizations are preparing to migrate their payment systems from SWIFT to the ISO 20022 standard, which is highly structured and data-rich.

By 2025, it will have established a global standard for all reserve currencies’ big and high-value payments networks. Furthermore, it will enable 87 percent of global transaction value and 80 percent of global transaction volume.

So, what is ISO 20022 all about? What is the significance of ISO 20022 standards for financial data interoperability?

Let’s start from the beginning!

What exactly is ISO 20022?

The International Organization for Standardization (ISO) is a worldwide federation of national standard-setting organizations. It is a financial services standard framework based on XML and other concurrent technologies.

For businesses interested in replacing outdated EDI (Electronic Data Interchange) standards, the ISO repository has various payment message standards and authorized remittance message standards.

Currently, there is no one standard for payment exchange instructions between local and international financial institutions in the global payment system. ISO 20022 (pronounced ISO twenty-two-two) was introduced in 2004 and would offer a collection of standard norms and procedures to improve international, regional, and local payments.

It provides a standardized platform for creating messages based on a set of XML and ASN.1 design principles, modeling methods, and a central dictionary.

Simply said, ISO 20022 is a new standard for delivering payment instructions that provides rules for financial institutions to share financial data across several marketing structures. The ISO 20022 flexible framework provides a globally agreed-upon business message syntax and semantics.

Apart from that, ISO 20022 will improve financial data interoperability by using XML-based methods, non-Latin alphabets, and coordinating formats that previously couldn’t operate together.

Why is ISO 20022 used?

In its financial repository, ISO 20022 publishes and stores the resultant models, patterns, and derived messages. Members of the financial community may also use ISO 20022 to define and extend groups of messages based on business syntax.

Members of the network have formed regional task groups to develop messaging standards for cross-border payments, reporting, and high-value payment systems, among other things. For high-value payment systems, ISO 20022 has already been implemented in the immediate payment markets of Australia, Singapore, Canada, and the United States, as well as nations with contemporary payment infrastructure such as India, Switzerland, and China.

From KYC checks to liquidity management, and from electronic banking to reporting, ISO 20022 will have a significant impact on banking operations. A bank’s success will be determined by its strategy and dedication, as well as its willingness to spend significant time and resources in the migration process.

Banks will have to carefully monitor and adjust changes to the implementation of ISO 20022 due to the diversity of methods in various countries. The more banks that use technology in their operations, the better other market participants will be able to route their payments via ISO 20022 banks.

ISO 20022’s advantages

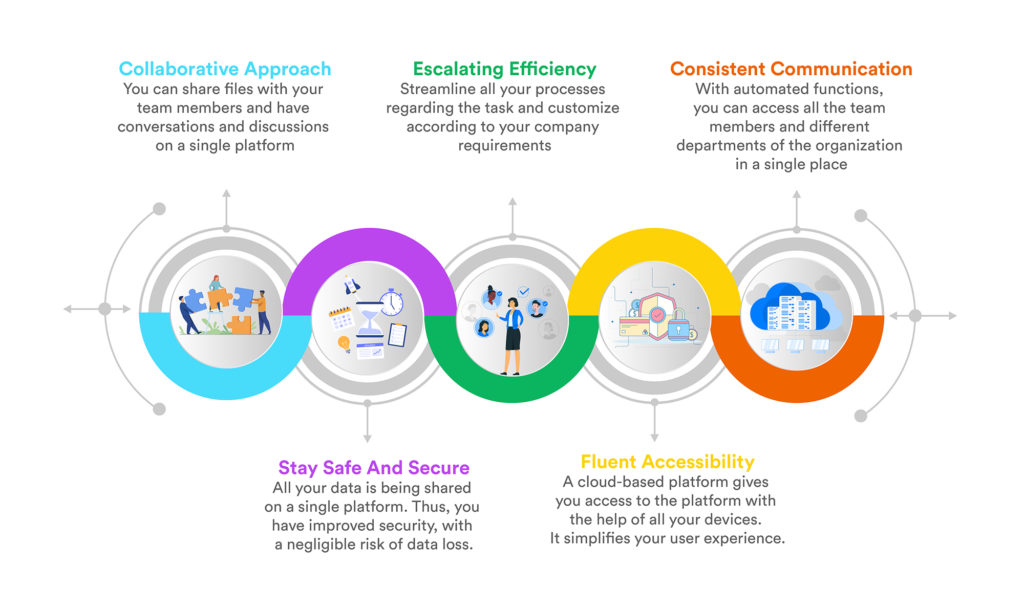

The worldwide adoption of ISO 20022 will result in a single language and model for payment data. The adoption of ISO 20022 will result in the creation of an open standard that can be adapted to new methods and changing requirements in the financial sector.

The following are some of the main advantages ISO 20022 may provide to a financial institution:

Improved client experience via more openness and better remittance data.

ISO 20022 will automate end-to-end business processes and whole business domains to boost straight-through processing and new offerings by encircling them with automation.

End-to-end payment system with very detailed data.

Product innovation will benefit from more freedom and data.

Non-Latin alphabets may benefit from ISO 20022’s efficient support and reference.

Conclusion

ISO 20022 aims to revolutionize the financial banking industry by establishing better standards for innovation. If you are a bank representative seeking to incorporate ISO 20022 into your banking application, you may employ a seasoned developer with years of expertise.

Thanks to Mahipal Nehra at Business 2 Community whose reporting provided the original basis for this story.