Call volume predictions are an unquestionably important tool in providing excellent customer service. The prediction for your program is a map that shows you where you should go depending on where you’ve been.

You’ll be lost at sea if you don’t have it. With it, you’re one step closer to providing an outstanding client experience.

However, predicting customer service volume usually depends largely on historical patterns. Volume trends and arrival patterns from the previous year (or quarter) may, and should, influence your forecasting of what’s to come.

There may be an abnormality from time to time, whether it’s a season or a month, owing to unforeseen events, but such oddities are usually just a stumbling block in the big picture forecasting process.

Until recently, most of us had never seen anything like the epidemic. We all scaled up or down based on what was going on in our businesses and what our consumers most required. But what’s next?

The term “new normal” bores us all to death, yet we can’t deny that the epidemic has rearranged our maps. The terrain has completely changed—the map shows us where we’ve gone, but it no longer shows us how to get there.

***

Consider a few instances from our outsourced customer service initiatives. One of our long-term customers, an eComm food retailer with over 15,000 same-day grocery delivery, became a necessary service in March 2020.

With cities under siege and every trip to the supermarket posing a danger, food delivery to the house became a lifeline rather than a convenience. Calls, emails, social media comments, and live chat sessions with questions and complaints about their service grew rapidly, as did the number of daily orders, the amount of orders, and their client base.

Day after day, week after week, contact volume surpassed 300 percent of projected. Volumes decreased once the most severe part of the initial wave had gone.

Volumes varied when successive waves arrived, each with its own set of limitations.

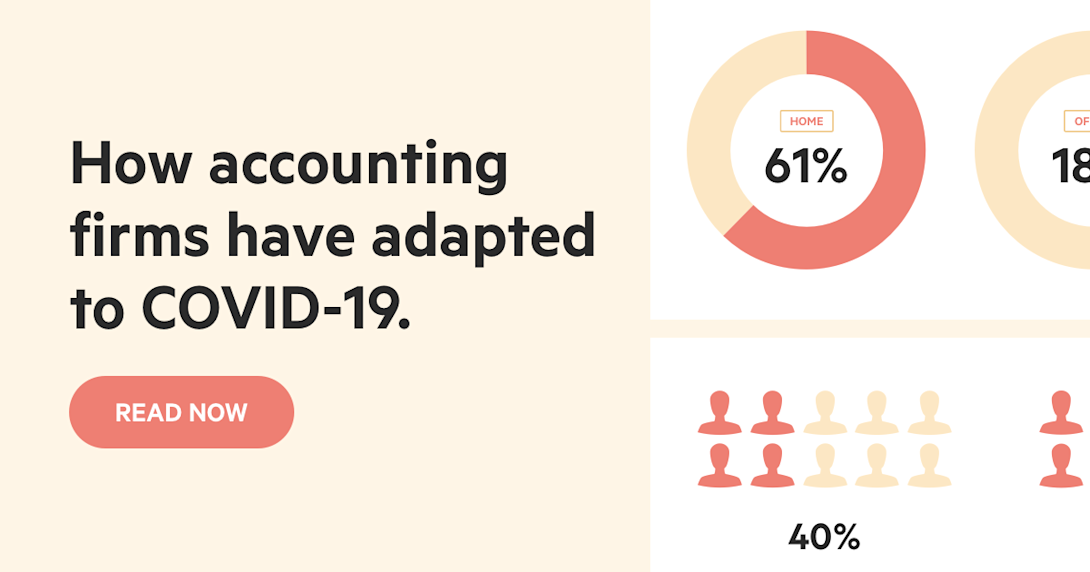

Another customer, on the other hand, is a worldwide travel insurance leader. For more than a decade, our team has provided claims opening assistance and customer care for this client, working in a tripod model with their in-house team and a second outsourced team.

They were our third-largest customer in March of 2020. Volume dropped as the epidemic spread and travel restrictions were imposed across the globe.

As traffic fell to practically nothing in the spring of 2021, the job that had previously been performed by three teams totalling more than 200 agents was now handled exclusively by a tiny inhouse staff. Our staff is back in work, although at a reduced capacity, while foreign travel resumes gradually.

At the time of writing, peak season is approaching at the same time as the fourth wave is gaining strength.

So, even on a rolling three-month basis, the recent past (year-over-year volume data) is unlikely to be an accurate predictor for the future 12 months for these customers, such as your own customer care program. Even if we eventually feel certain that we are really post-pandemic (crossing our fingers), it does not imply that trends will revert to pre-pandemic levels.

COVID has permanently impacted consumer behavior and B2B settings for many companies.

So, how should companies approach contact center forecasts in the next year?

***

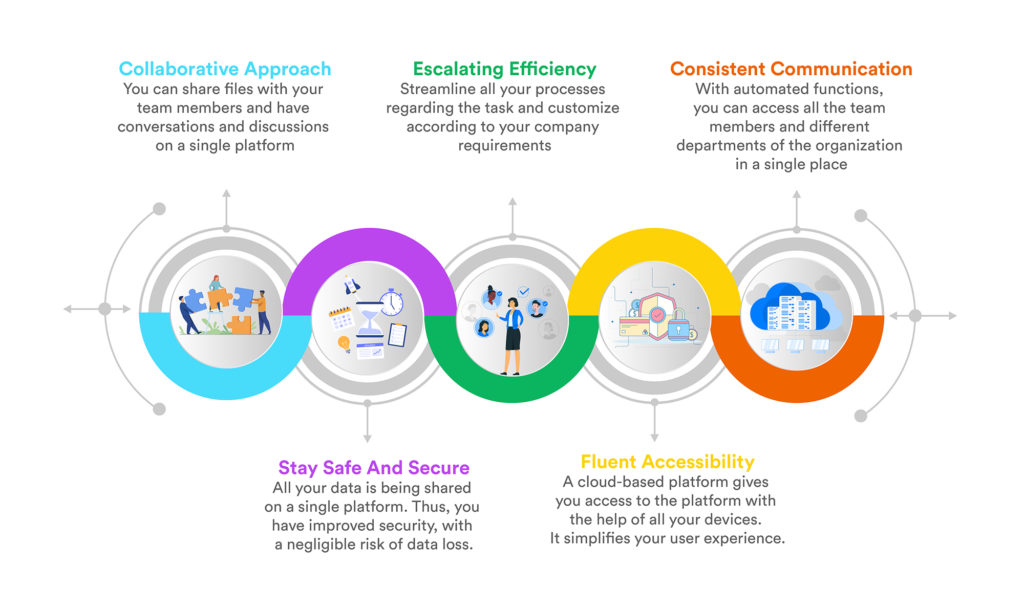

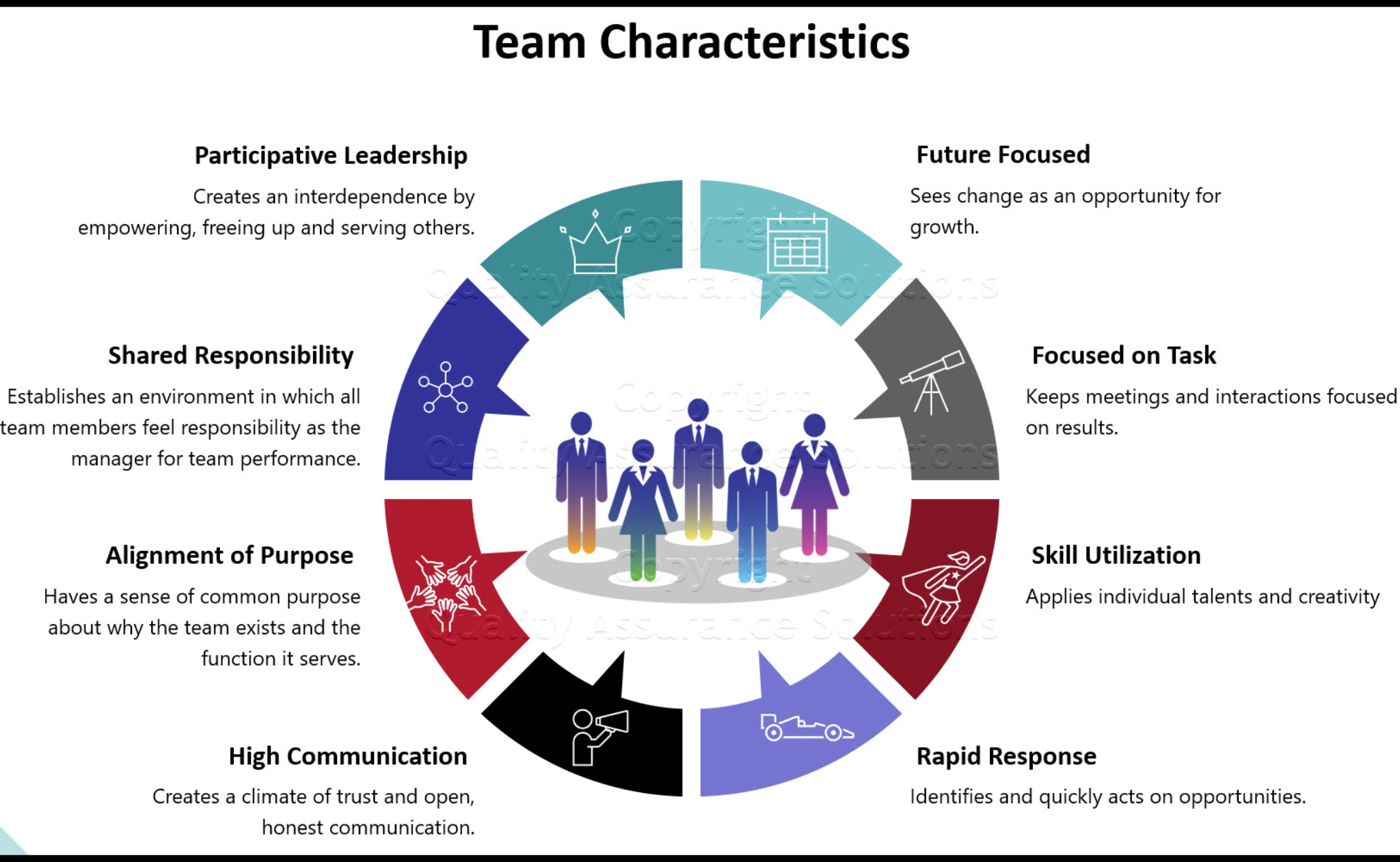

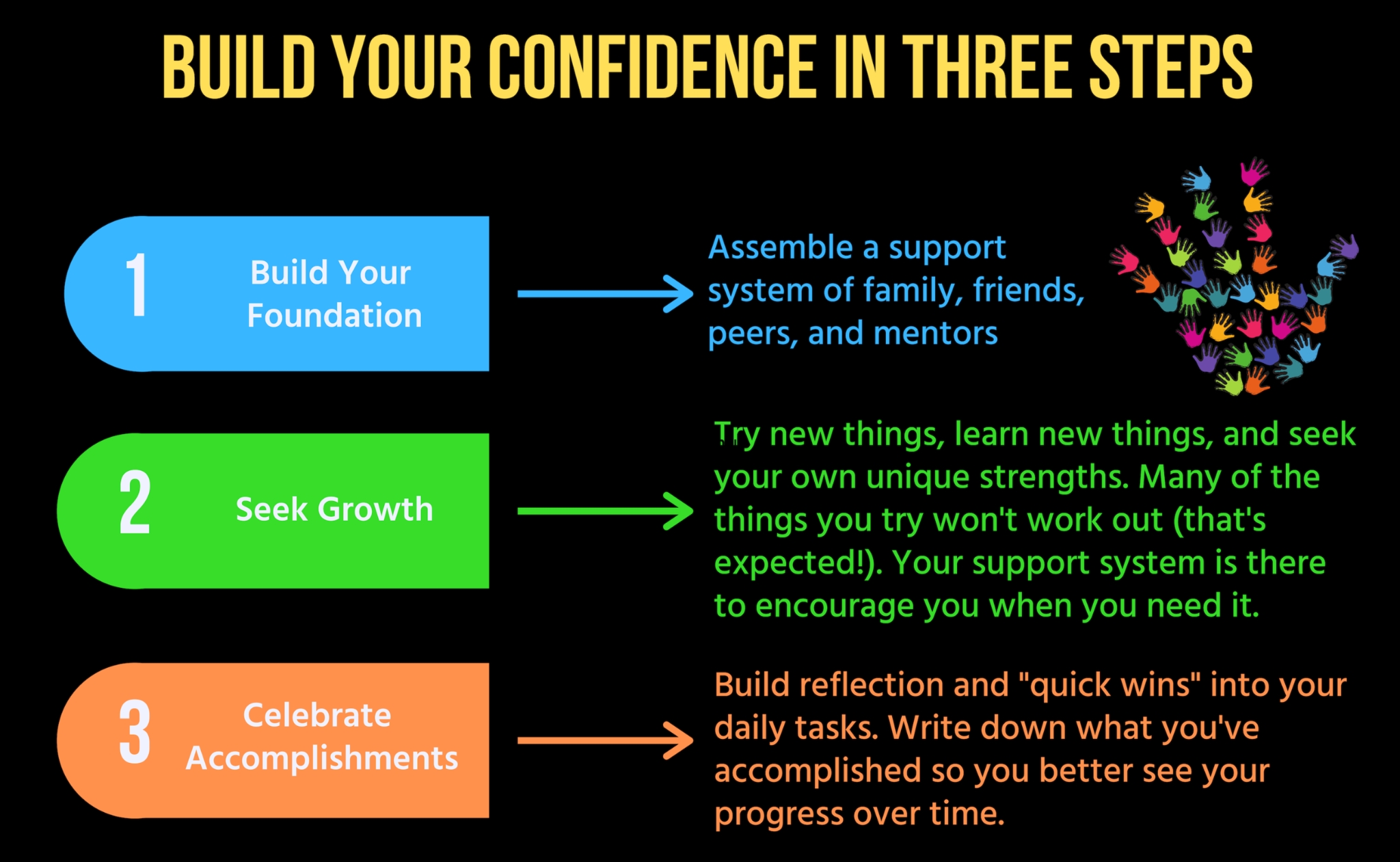

Forecasting is, by definition, a collaborative and multi-faceted endeavor. The objective of an outsourcer’s workforce team is to provide forecasts for the customer, who then applies them to their particular business situation.

The modeling is returned to us at that time, and we put it to use — creating staffing models. Real-time information, industry trends, economic indicators, business campaigns, and external variables are used to supplement historic patterns.

In a nutshell, it’s a sophisticated algorithm that feeds the insights of labor management specialists who use their own knowledge and make educated “reads.”

The current situation invites the question: how can you accomplish that with such a large gap in typical information? Is there any value in information gathered during non-covid periods?

We must start by examining historical patterns, both pre- and mid-pandemic, and determining what is important to now and future. It’s about figuring out what motivates your consumers to purchase and engage the way they do.

It entails gaining a better understanding of your industrial sector and company strategy in order to spot subtle patterns and indications.

Stay closer than ever with your workforce team, whether it’s an outsourced partner or your own internal team, throughout the forecasting process over the following 12 months, is our advice. Collaboratively parse the data and add your own business predictions to the forecast for the next months.

Are you able to access and use relevant data inputs over the last 18 months? In consumer retail, for example, you’ll have a good idea of the percentage of orders that need to be contacted.

Has that proportion become bigger or lower over the last year and a half, or has it stayed the same as it has in the past? When you combine that information with your sales team’s quarterly predictions (which include various possibilities based on the fourth wave’s possible effects), you’ve got a solid basis for your forecast.

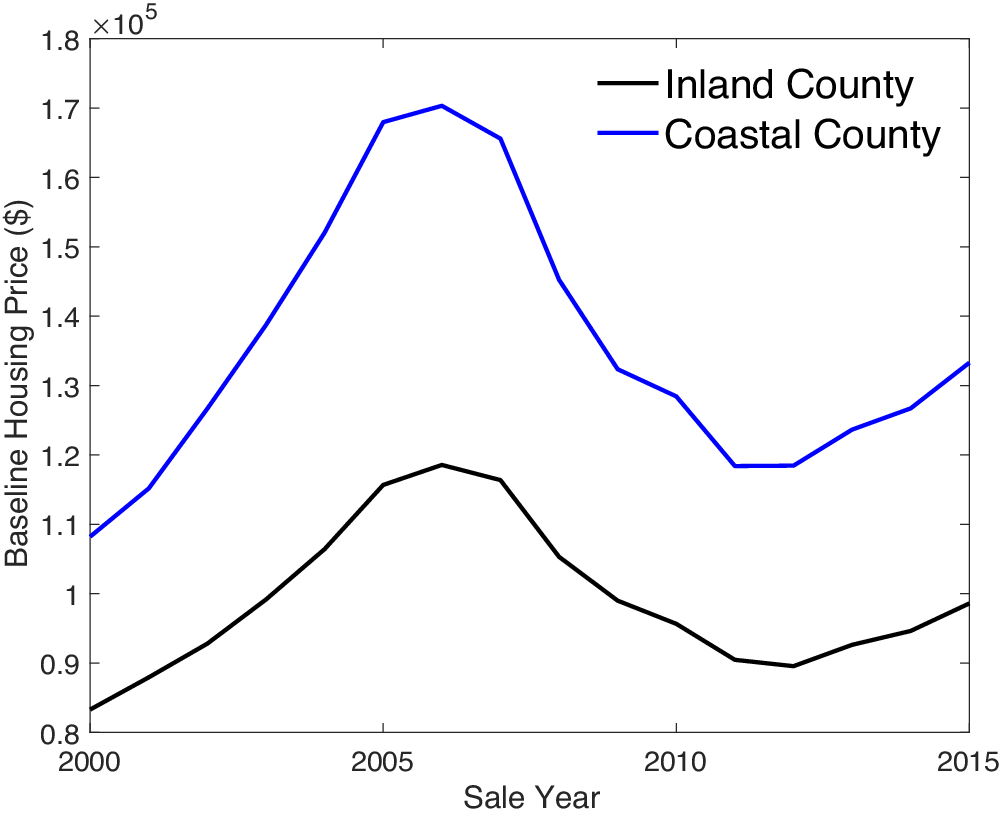

For example, our supermarket eComm customer can’t look back at business circumstances in 2019 since their underlying company has undergone a significant and long-term shift. Consider the relatively steady business climate of 2019: our customer made 10,000 deliveries each day, with X% of orders resulting in a contact.

Today, daily deliveries exceed 15K in the second half of 2021, and we have a new baseline of orders: contacts. As a result, we look at order drivers based on recent history and then apply that information to the new business base.

In a nutshell, every company has valuable data that they are working to operationalize. Your workforce team can take that operational information and build out from known patterns if they are completely engaged in your company and fully looped into that operational strategy (e.g., percent of orders driving contact). That is, we overlay a derivative prediction with new business realities based on business reality (rather than a forecast based only on previous experience).

Finally, forecasting is critical to a successful customer service program because it provides a starting point for workforce management to develop effective staffing plans to meet service level promises that are consistent with your customer experience. Every effective customer support encounter starts with easy access to a fast, efficient, and accurate response.

And corporate executives want to keep their profit margins as high as possible. Workforce management attempts to strike a balance between these goals, which is made possible by accurate predictions.

Forecasters and workforce managers will simply have to adopt an agile mindset, recognizing that things are constantly changing and consumers are still adjusting to their new normal.

Thanks to Mahipal Nehra at Business 2 Community whose reporting provided the original basis for this story.