According to a report, Deutsche Bank’s hazardous investment in a bankrupt cargo-shipping business is expected to provide a $1 billion profit for the scandal-plagued banking behemoth.

The large profit – which accounts for a quarter of the bank’s investment banking earnings in 2020 – represents a significant turnaround for a bank that has lost money for five years and had numerous run-ins with regulators, forcing it to lay off 18,000 people as part of a massive restructuring effort.

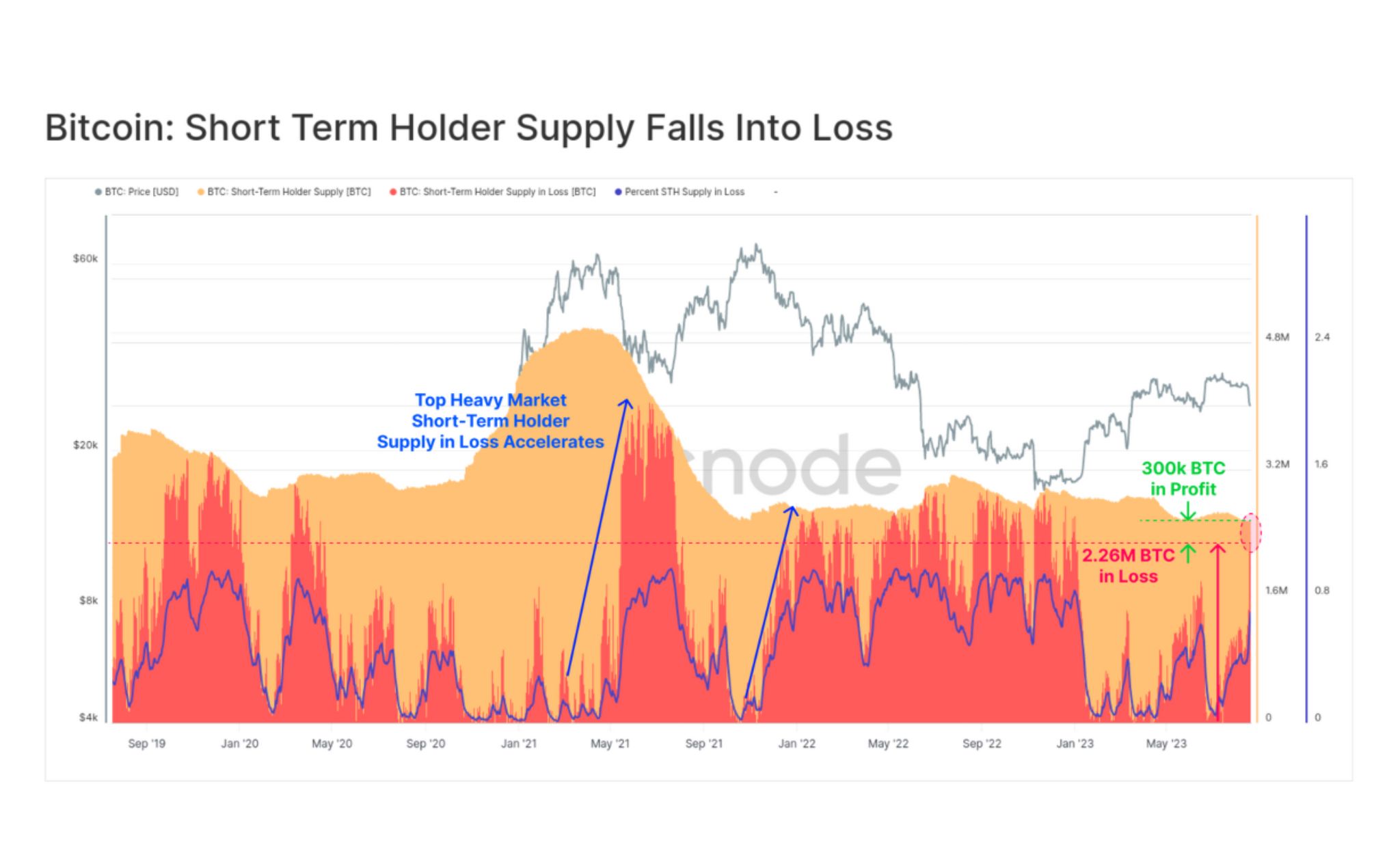

The German lender started scooping up tens of millions of dollars in bonds, bank loans, and stock from Zim Integrated Shipping Services Ltd. in 2016. At a time when shipping revenues were at all-time lows, the debt-ridden Israeli freight transport business had recently completed a reorganization.

According to Bloomberg, one trader at Deutsche Bank, Mark Spehn, thought the maritime industry’s consolidation and Zim’s management would make the gamble a winner (paywall). The previous year proved him correct.

In the second half of 2020, the business sprang back to life thanks to soaring customer demand and a crackdown on carbon emissions. Zim, the eleventh biggest shipping company, went public in January. The stock has increased by 290 percent since its first public offering. According to the article, the bank has already paid out $90 million in shares and still owns $645 million in the business.

In a canal, there is a cargo ship.

Deutsche Bank’s investment on a freight business may yield a profit of $1 billion.

It will be the German bank’s largest payout since a $2 billion bet on subprime assets during the financial crisis. The announcement comes only weeks after Deutsche Bank announced its highest quarterly profit in seven years.

This year, Zim is anticipated to pay dividends to shareholders, and according to Jefferies, the company’s cash flow and balance sheet will strengthen.

Christian Sewing, the CEO of Deutsche Firm, has expressed confidence that the bank is on the right road. “Our first quarter is additional proof that Deutsche Bank is on the right track in all four main businesses, and is generating sustained profitability,” he stated in April.

Thanks to Mahipal Nehra at Business 2 Community whose reporting provided the original basis for this story.