You made a little more money with your last salary and still have some after paying your mortgage or rent, as well as any other necessary expenditures. Rather than squandering the funds, you could put them in a savings account or use them to pay off some of the debt that has been weighing heavily on your mind.

But here’s the million-dollar question: should you save your money or pay off your debts first, particularly when it comes to long-term spending?

Both of these methods can, in fact, be useful. But first, let’s go over the advantages of saving money or paying off debts first, so you know what to do when payday arrives.

When Is It a Good Idea to Save Money?

Saving money is always a good idea, and thanks to automatic saving apps, it’s easier than ever. In addition, thanks to AI Chatbots and other innovations, the banking and finance industries now have their own tools. In any event, if you wish to save money for any of these aims, saving money can be a great option.

A contingency fund

An emergency fund is a little amount of money set aside for a “rainy day.” You won’t need to take out a loan or use your credit card to cover the cost of car repairs, house repairs, or even modest medical expenditures if you have an emergency fund.

Furthermore, if you lose your current employment due to a global disaster such as the pandemic or something else, an emergency fund can assist you transition from job to job.

If you don’t have an emergency fund, you may need to take out personal loans, which are short-term loans that allow you to borrow money for a specific amount of time. However, you’ll have to repay the loans sooner or later, adding another burden to your list of obligations.

Put money aside for a large (but necessary) purchase

When possible, it’s also a good idea to save money instead of using a credit card or a loan to make a large buy. You’ll avoid harming your credit score by saving for a TV, a new car, or even new furnishings for your home, and you’ll also be practicing excellent financial responsibility.

Invest in your 401(k)

If your workplace offers a 401(k) plan with a high matching percentage, it’s a no-brainer to put a portion of your income into it so you can start saving for retirement as soon as possible.

The Advantages of Paying Off Debt Quickly

However, for the following reasons, it may be advisable to pay off your debt rapidly with a winning money strategy.

Several debts with different interest rates

If you have many debts in your name, each with its own interest rate, interest will collect on each of them. This can have a significant negative influence on your wallet over time, causing you to spend far more for each loan than you would otherwise.

If this is your financial condition, it may be wise to pay off your debts as soon as possible to avoid the accumulation of various interest rates.

If debt collectors or other agencies are continually hounding you about making payments, paying off your obligations sooner rather than later may be your best option.

Your credit rating is deteriorating

If your credit score has dropped dramatically and is still falling, you can stop it by paying off your bills as soon as possible and beginning to restore your credit.

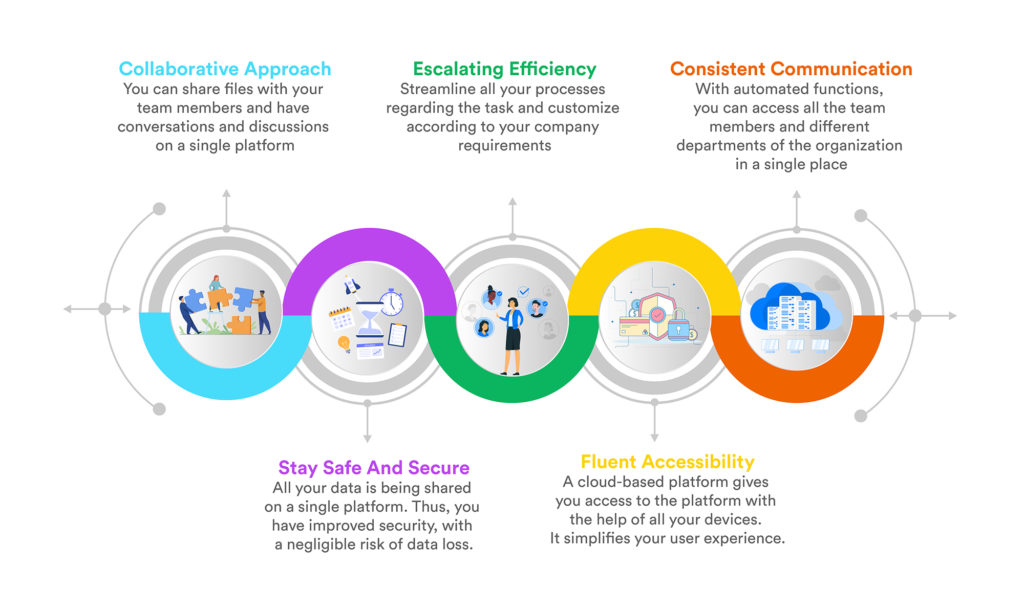

How to Save and Pay Off Debts at the Same Time

You may not need to save money or pay off your debts in some circumstances; you may be able to achieve both at the same time and gain control of your finances. Here’s how to do it.

Using the Snowball Method to Pay Off Debts

The snowball debt payment approach is paying off the smallest obligations under your name as quickly as feasible. Then, once those bills are paid off, go on to the next biggest responsibilities, and so on, until you are debt-free.

You’ll save money on interest over time and improve your credit score at the same time if you do it this way.

Of course, if you do not plan to pay off your obligations as soon as possible, you may want to consider purchasing life insurance. For example, if you die unexpectedly, part of your debts may pass to family members, such as your spouse.

A comprehensive life insurance policy with guarantees like death benefits can provide enough money for your spouse or other family members to pay off your obligations and avoid being impacted by them for years.

After you’ve paid off your debts, start saving

Once your bills are paid off, you can resume active saving. Any money you would have spent on your debts could be put into a savings account, a 401(k), or otherwise set aside for your future financial goals.

How Much Should You Put Into Savings?

Although saving any amount of money is a good idea, many experts advocate building up your emergency fund to the point where it can cover three to six months’ worth of costs. To save up enough money for that, put it in a savings account, and you’ll be safe in the case of another major economic disruption like the COVID-19 pandemic.

Make a Rainy Day Fund

To begin, save aggressively for the first few weeks or months of your plan to build an emergency fund of at least a few hundred dollars. After you’ve established this emergency fund, you can continue on to the following phase.

You can use an emergency fund calculator to figure out how much money you’ll need for an emergency fund depending on your salary, bill payments, and other factors.

In the end, saving money and paying off debts are both good actions, and you should be proud of yourself for thinking about them rather than squandering any spare cash.

Depending on how much money you have to work with, you may evaluate if it’s better to pay off your debts first, save until you have a tiny nest egg in a savings account, or accomplish both at the same time with the correct plan and some self-reflection.

Thanks to Kiara Taylor at Business 2 Community whose reporting provided the original basis for this story.