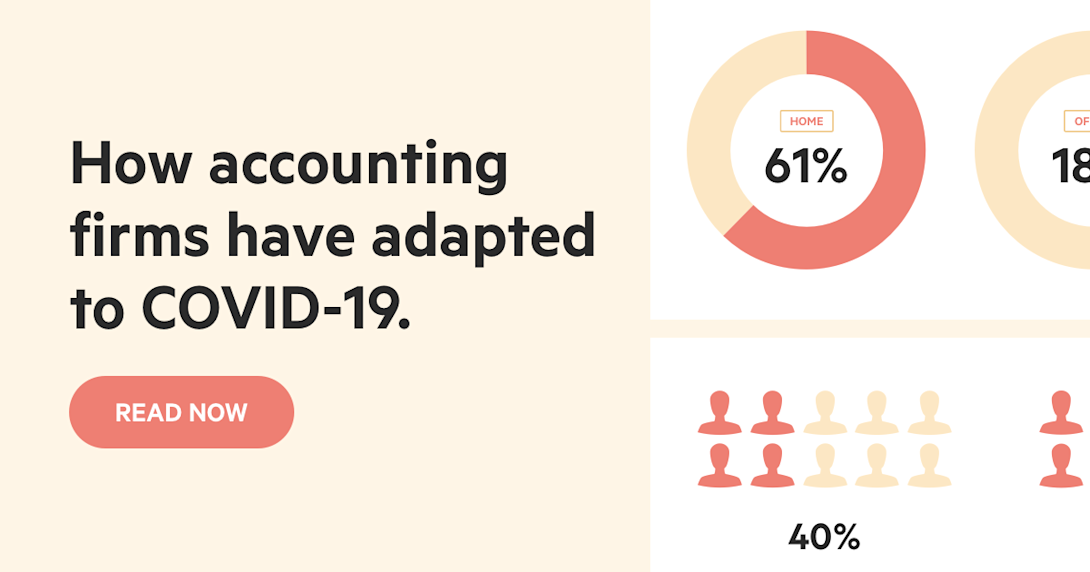

The COVID-19 epidemic had a significant influence on businesses in practically every industry. As a result of the impact, business owners like you have had to deal with a slew of new issues.

In 2021 and beyond, you may face challenges such as a significant shift to remote work, a shifting labor market, and new consumer behavior trends, to name a few. If you were considering selling your business before the epidemic, you probably postponed your plans.

The health-care crisis wreaked havoc on the economy, preventing most would-be vendors from completing transactions. However, compared to 2020, deal volume is increased.

Furthermore, at 36%, the net percent of owners who have hiked selling prices is at its highest level in decades.

Is it a smart time to sell your company now? The data paints a fairly clear picture. However, they may not be able to show the entire image.

Before you sell your firm, you should do some research on the market.

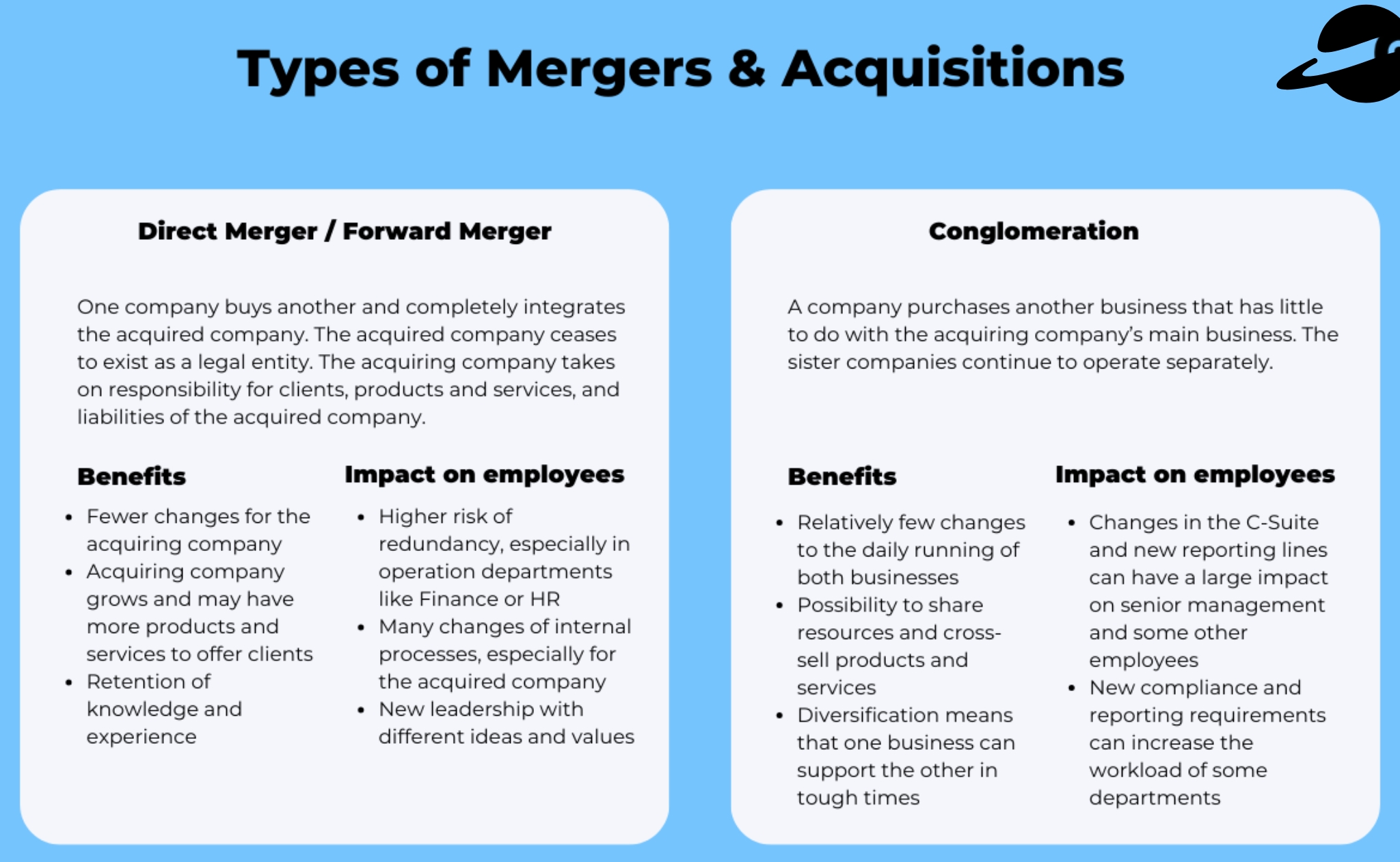

When deciding whether or not to sell your company, it’s a good idea to consider the acquisition from the standpoint of an investor.

For many people, the health situation continues to be a major concern. Prospective purchasers are less likely to value your performance throughout the epidemic than you may believe.

COVID-19 has had both beneficial and bad consequences on margins. Demand, supply chain interruptions, health concerns, and other factors all contribute to this volatility.

The 11 percent of companies that claimed positive effects from the pandemic were in industries that provide critical products, including as consumer goods and life sciences. Carmakers, event planners, hospitality enterprises, and manufacturers of industrial equipment, on the other hand, generally reported the reverse.

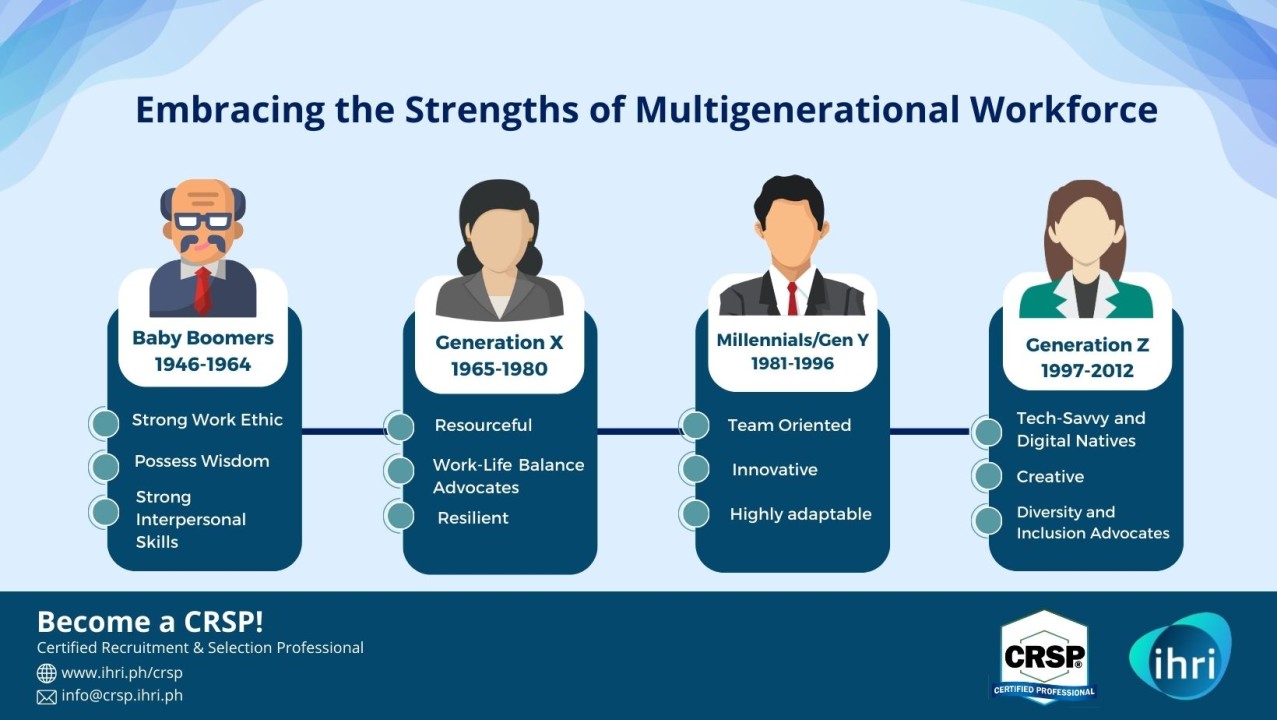

While the current atmosphere may be the start of a new standard, many firms are still feeling the effects of the pandemic. For example, the labor market is still in upheaval.

Companies that are understaffed may be unable to take on more work. As a result, just because margins are high or low now doesn’t mean they will remain that way in the future.

Indeed, increasing labor costs and continued supply bottlenecks, among other factors, may cause more enterprises to endure margin reductions.

Considering the impact of the pandemic on your business

The majority of the issues that impacted (and continue to effect) your firm as a result of the health crisis are most likely outside your control. This is something that astute investors will recognize.

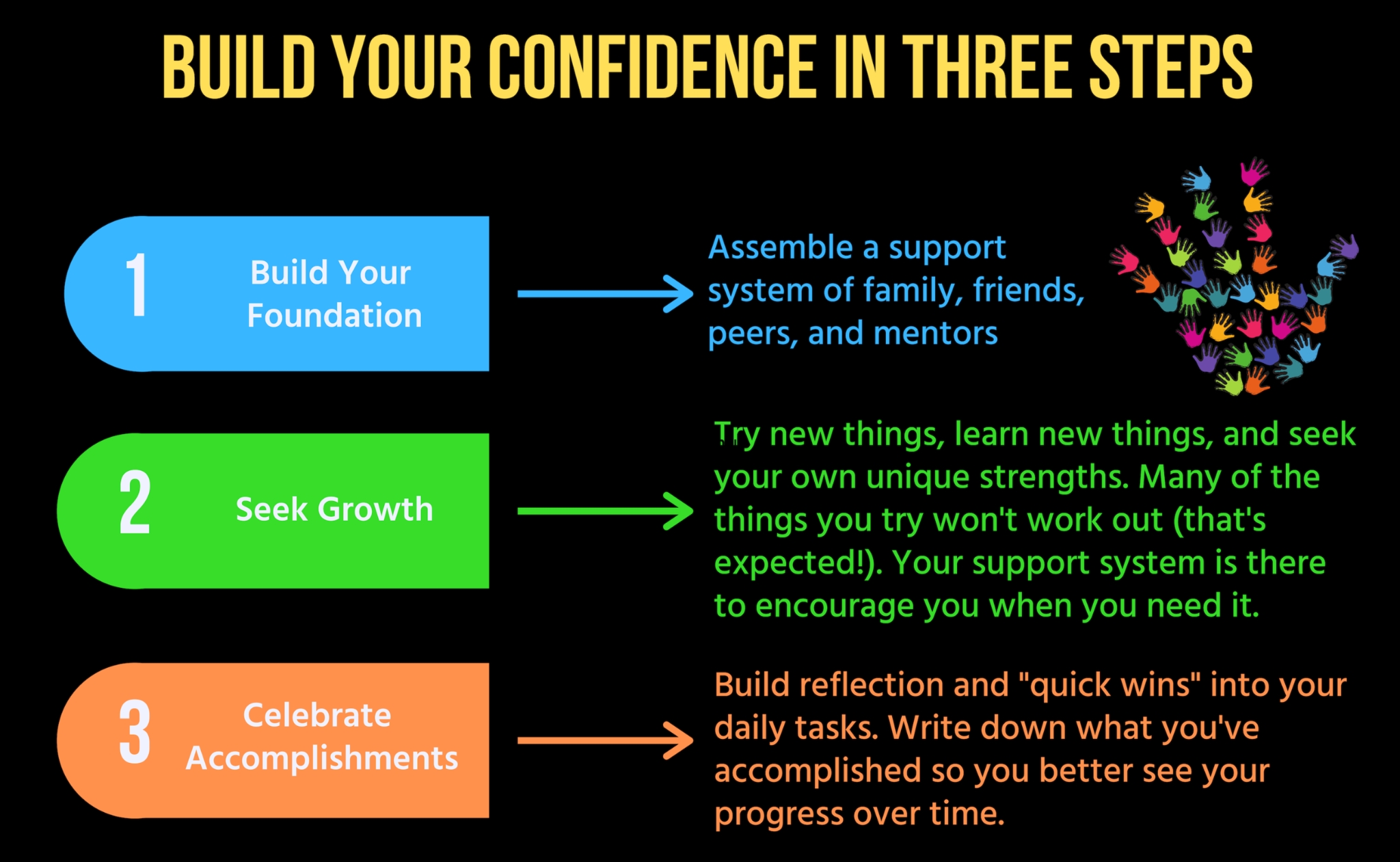

They’ll care more about how you handled lockdowns and mandated quarantines. After all, your company’s long-term viability is determined more by your adaptability during COVID-19 than by the income you produced.

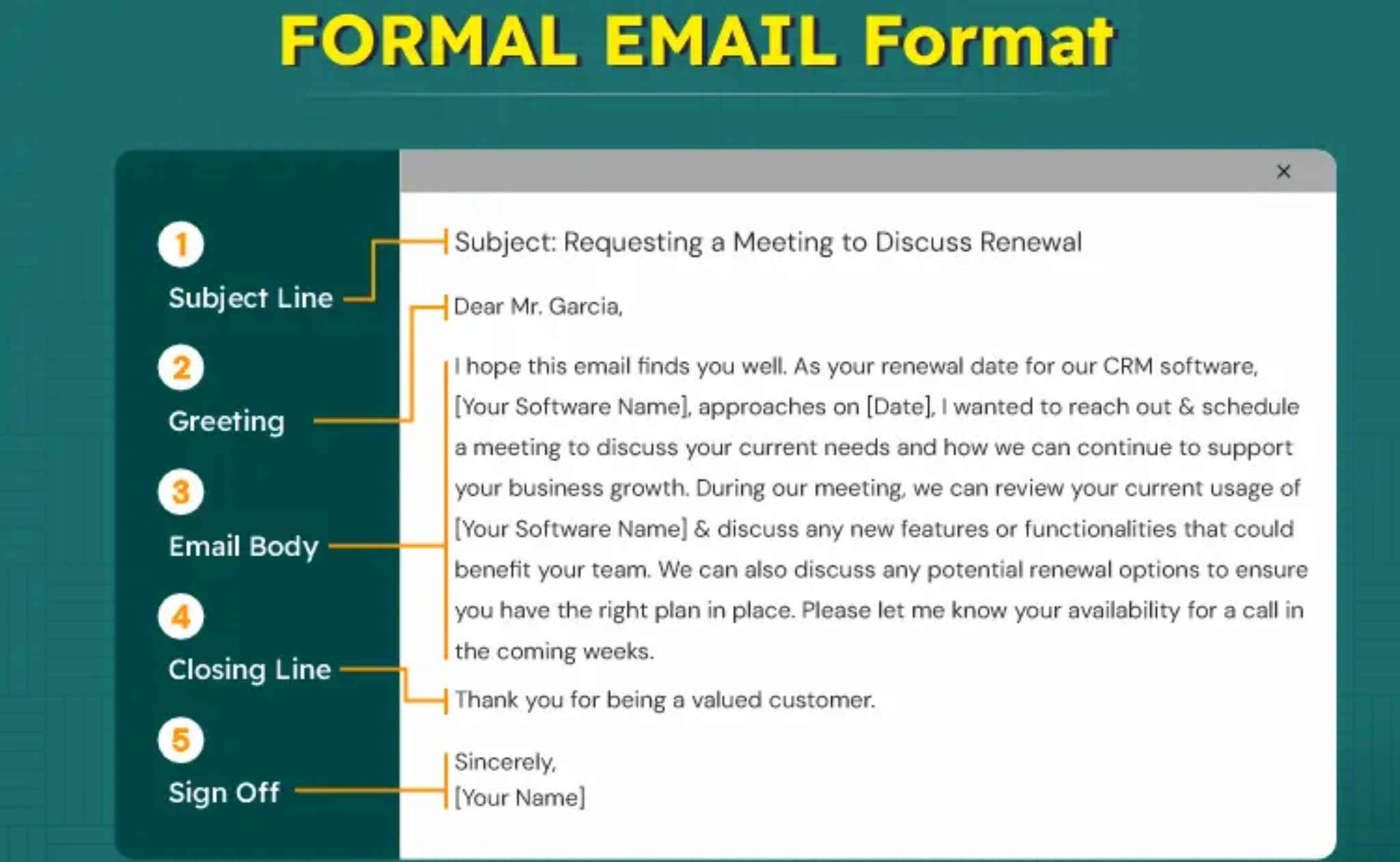

Investors will want to know if your employees have returned if your company was one of the many that experienced workforce disruption in the past year. They’ll also want to know if your staff are working in the office, remotely, or in a hybrid setting. \

They’ll also have concerns about demand. Are buyers placing normal-sized orders? Existing consumers are contacting you with fresh questions.

Do you receive any queries from possible new customers?

The epidemic put a stop to demand just a year after Americans spent over $10 trillion on services. As a result, people began to save rather than spend.

According to Deloitte, personal savings rates in 2020 will be twice as high as they were in 2019. Investors want to see your company take advantage of new prospects when consumer spending rises as more people receive immunizations.

How to properly sell your firm

Even if you had no intention of selling your company before to COVID-19, you may believe that the current situation offers prospects that are simply too wonderful to pass up. On the other hand, you may be fatigued from the effort of running a business in the midst of a pandemic.

If that’s the case, you’re probably ready to delegate that task to a new group.

It’s a difficult decision to make, whatever your reasons for selling your firm are. There’s no guarantee that you’ll receive the result you want. However, by planning ahead of time and understanding what buyers want, you can increase your chances of achieving the best price for your business – and possibly avoid future seller’s regret.

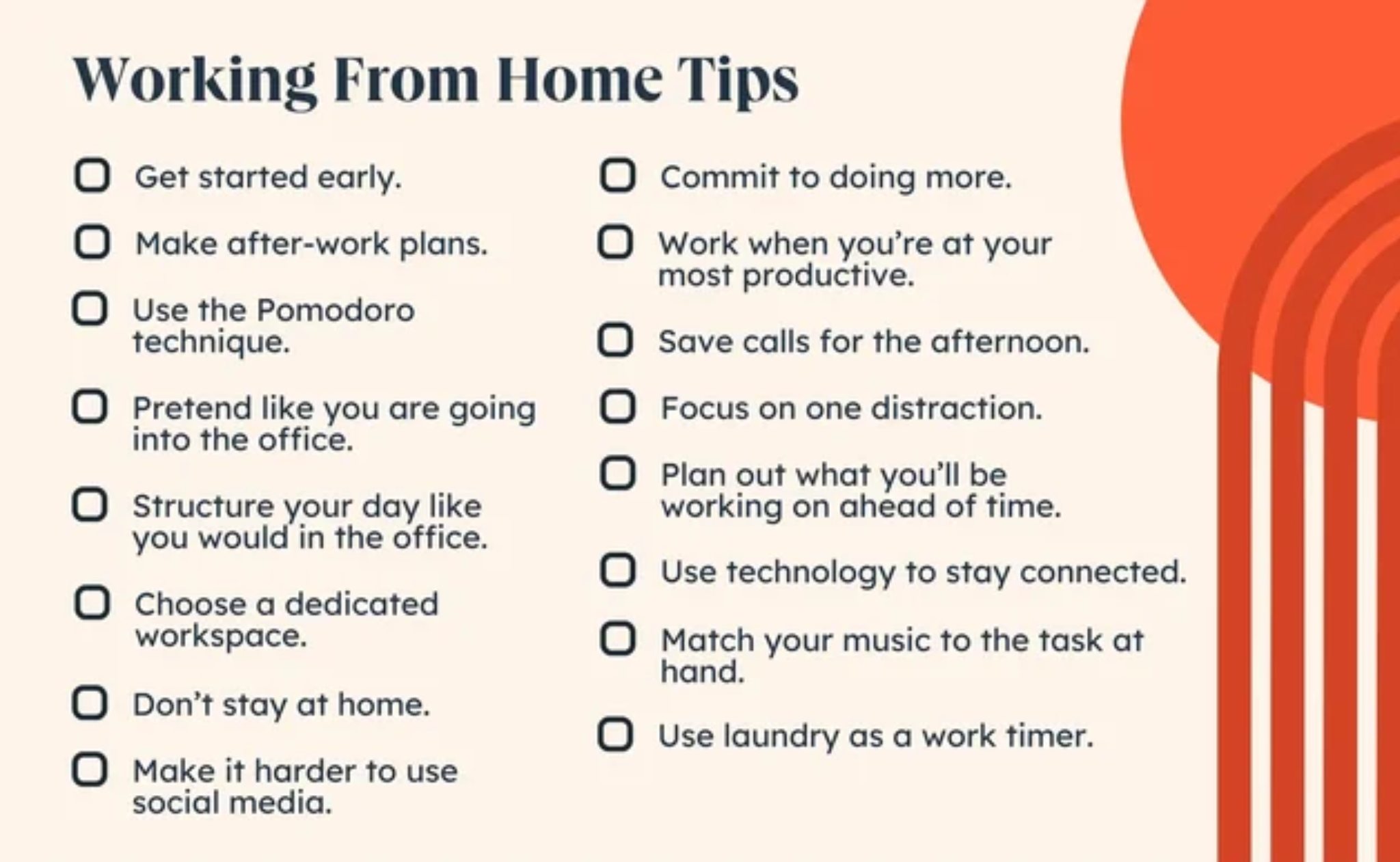

The checklist that follows will assist you in this attempt.

A checklist for increasing the value of your company during a sale

When it comes to selling a firm, it’s not always clear what factors to consider. This checklist will assist you in addressing issues that investors would most likely assess and enquire about during the buying process.

Every business is different, but the action items listed below may and should be addressed before selling yours. You’ll also find extra information and concerns that, depending on the type of your firm, may be important to you.

1. Assess the strength of each line of business and each business function objectively.

It’s possible that your company is solely focused on one product or service. It could also generate revenue from a variety of different service lines.

In the first scenario, you can think about increasing your product line as a means to spur growth. It’s fine if you don’t fully commit to this effort until you meet with potential customers.

When it comes time to make a deal, though, knowing that multiple prospective expansion prospects are available could work in your advantage.

However, if your company is significantly fragmented, you might want to look into consolidation or rationalization options before selling it. Investors will not give much weight to product or service lines that have little long-term growth potential.

Offerings having little to demonstrate in the way of profitability will not be accepted. Don’t look at each line of business in isolation.

Consider how each of them affects your selling pitch in light of broader market changes.

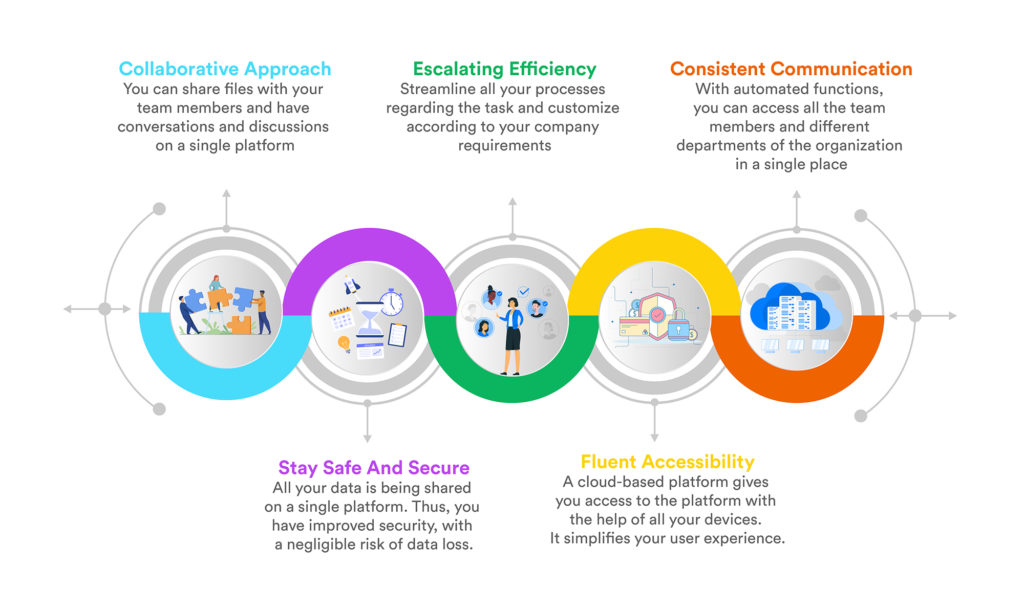

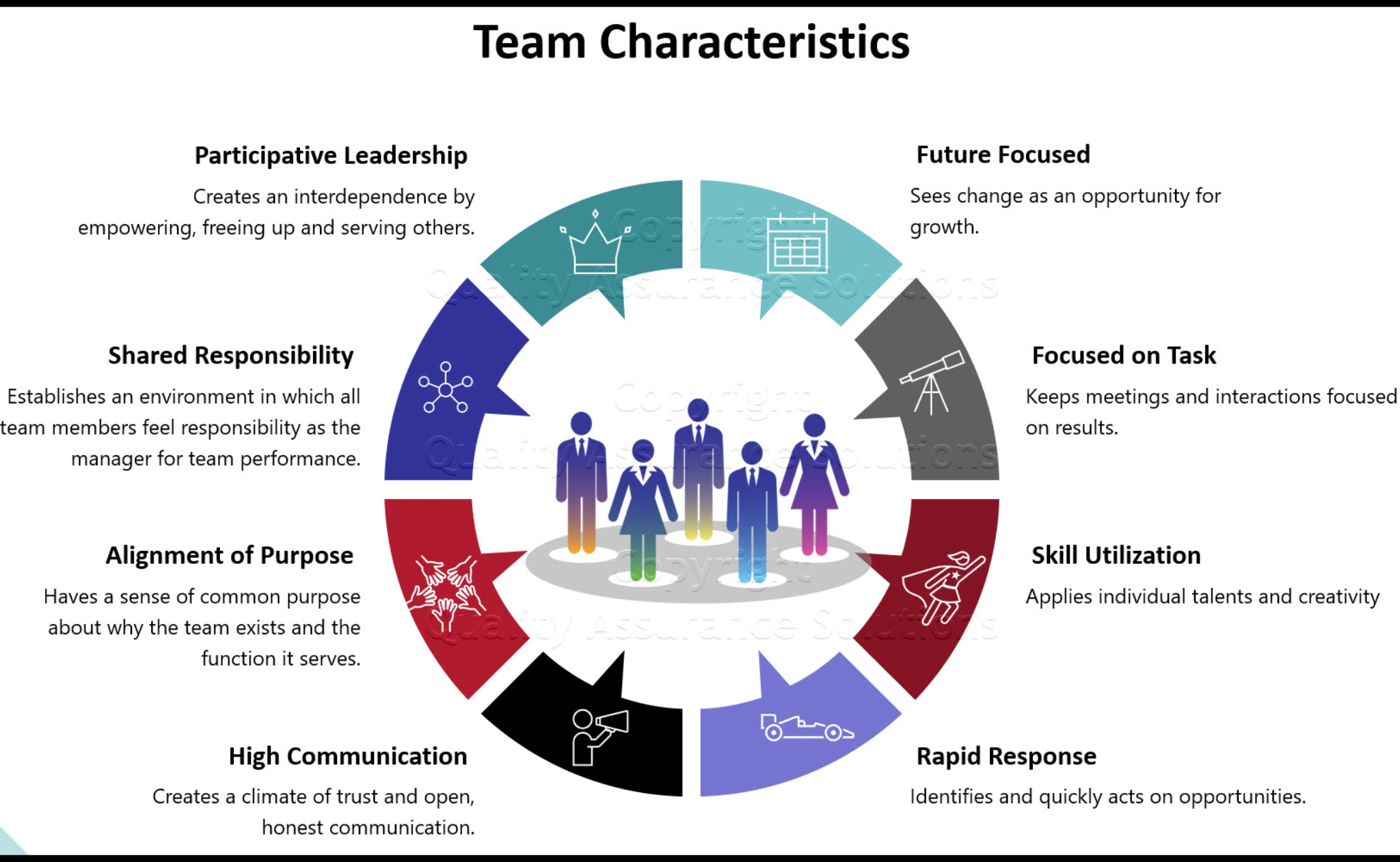

You’ll need to assess your company’s present leadership in addition to your primary revenue-generating operations. Buyers must believe that the management team is both complete and competent in order for a business to sell at a premium price (or even at all).

You might still be able to complete a purchase if prospective investors believe that the management team needs to be enhanced or that particular individuals need to be removed. However, your company’s value may suffer as a result.

Your sales and finance divisions will be scrutinized by investors. Consider the case when you don’t have a dedicated controller or chief financial officer.

Investors will inquire about your company’s financial management. You must be prepared to give detailed answers to these questions.

Include all information on all company functions in a comprehensive presentation bundle once you’ve obtained it. During the negotiations, investors might look at the package.

2. Determine customer concentration and trends.

Investors typically consider a company with more customers to be less risky than one with fewer consumers. That isn’t to claim that having more clients means you’ll make more money.

For example, a company with one or two large government contracts might have more impressive revenue than one with dozens of commercial clients. All contracts, however, must come to an end at some point.

Investors want to know that your business can find, attract, and retain new clients when the time comes.

So, what if one or two clients account for a significant amount of your company’s revenue? Here’s a good rule of thumb to remember: If a single customer accounts for more than 30% of your revenue, investors will raise red flags.

In some industries, this is a rather common occurrence. If your selling argument is otherwise excellent, a high consumer concentration may not be a deal breaker.

Just keep in mind that if the percentage is higher than 30%, some investors may be hesitant to invest. Those who don’t will spend a considerable amount of time assessing your main consumer.

That method isn’t optimal for either you or them. Simply simply, if your client concentration is low, you have a better chance of getting a good bargain when selling your business.

3. Investigate COVID-19’s long-term consequences.

As previously said, the pandemic might have had a variety of effects on your company. In 2020, the crisis led in around 200,000 more permanent business closures than in previous years.

At the very least, the fact that your organization is still operating demonstrates your tenacity. Buyers, on the other hand, are more concerned with the future than with the past.

Your company’s performance during the epidemic isn’t a reliable predictor of future performance. After all, the circumstances surrounding COVID-19 were unusual for most companies.

However, if you’re still struggling with residual consequences after selling your company, you should investigate them. Try to guess how long they’ll last.

Also, consider what they signify for your company’s long-term prospects. You can better approach conversations with potential purchasers about the pandemic’s effects on your firm by adopting these analysis and forecasting procedures.

4. Determine the growth levers for your company.

Investors are searching for a profit on their money. Targets and timelines may differ significantly from one buyer to the next.

All purchases, however, are made with the goal of expanding the company. With this in mind, demonstrating recent growth is frequently your greatest bet for increasing your company’s value.

Thanks to Nick McLean at Business 2 Community whose reporting provided the original basis for this story.